Hsa Tax Savings Calculator 2022. Using this calculator, you can figure out how much you could be contributing to a health savings account (hsa). To start, please enter the following information about yourself.

In 2021, your maximum allowable hsa contribution is in 2022, your maximum allowable hsa contribution is. If you're 55 or older, you can put. Please note that hsa contributions are adjusted annually to reflect the cost of living.

Remember, An Hsa Is A Health Savings Account, So It Acts Like A Savings Account And Earns Interest.

Impact of paying for qualified health care expenses from your hsa vs. If you're 55 or older, you can put. The maximum amount of money that can be deposited into an hsa depends on several factors including the account holder's age, and whether the person has single or family coverage.

Example Is For Illustrative Purposes Only.

Ad save time editing documents. What is your plan type: What is your state tax rate?

Hsa Funds Roll Over Year To Year If You Don't Spend Them.

Sorry, new jersey and california, any hsa earnings are considered taxable income. This health savings account (hsa) calculator determines the amount you are allowed to contribute to your hsa account for the current tax year. But unlike a regular savings account where interest earned will be counted as taxable income, your hsa contributions can grow without the tax hit.

2022 2021 $ What Was Your Taxable Income?

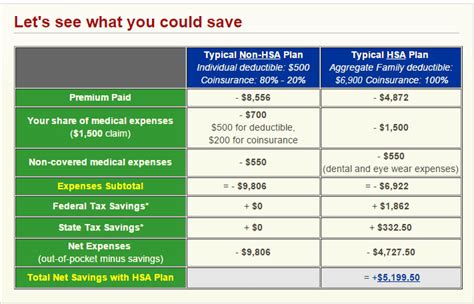

This calculator will show you just how much you are saving in taxes by making contributions to a health savings account (hsa). If eligible, your employer may add $750 (individual coverage) or $1,500 (family coverage) to your hsa. Using this calculator, you can figure out how much you could be contributing to a health savings account (hsa).

For 2021, The Individual Coverage Contribution Limit Is $3,600 And The Family Coverage Limit Is $7,200.

Next, we'll need to know some information about your situation. If you're wondering how much you should contribute to your hsa, visit our hsa future value calculator. The guidance also includes the 2022 limit for health reimbursement arrangements (hras), which remains $1,800.