Income Tax Brackets 2022 Us. In 2021, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (tables 1). If you found the united states annual tax calculator for 2022 useful, please vote and / or share below as it helps us to shape future developments and keep icalculators salary and tax calculators free for all to use, without your support, we may need to close down this service or charge for it in the future, please help us to keep this free for all to use.

Applicable in addition to all state taxes. Choosing not to have income tax withheld. 19c for each $1 over $18,200.

The 2022 Financial Year Starts On 1 July 2021 And Ends On 30 June 2022.

This means that these brackets applied to all income earned in 2021, and the tax return that uses these tax rates was due in april 2022. Single $12,950 n/a n/a head of household. If you found the united states annual tax calculator for 2022 useful, please vote and / or share below as it helps us to shape future developments and keep icalculators salary and tax calculators free for all to use, without your support, we may need to close down this service or charge for it in the future, please help us to keep this free for all to use.

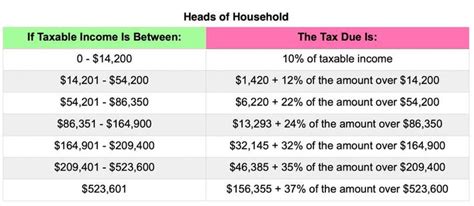

Your Bracket Depends On Your Taxable Income And Filing Status.

Calculate your income tax brackets and rates here on efile.com. In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to. Your personal allowance may be bigger.

Us News See Links Of Interest

10%, 12%, 22%, 24%, 32%, 35% and 37%. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of $523,600 and higher for single filers and $628,300 and higher for married couples filing jointly. Taxable income up to $10,275.

10 Percent, 12 Percent, 22 Percent, 24 Percent, 32 Percent, 35 Percent, And 37 Percent.

The tax rates themselves didn't change from 2021 to 2022.nevertheless, the 2022 tax brackets were adjusted to account for inflation. Tax planning is all about thinking ahead. Choosing not to have income tax withheld.

In 2021, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Tables 1).

Applicable in addition to all state taxes. $51,667 plus 45c for each $1 over $180,000. The irs changes these tax brackets from year to year to account for inflation and other changes in economy.