Income Tax Brackets 2022 Married. Your bracket depends on your taxable income and filing status. The irs recently announced the new tax brackets for the 2021 tax year, to be filed in 2022.

35%, for incomes over $215,950 ($431,900 for married couples filing jointly); For instance, a married couple filing a joint return with $100,000 of taxable income in 2022 won't pay $22,000 in tax just because their total taxable income falls within the 22% bracket for joint. Your bracket depends on your taxable income and filing status.

In Tax Year 2020, For Example, A Single Person With Taxable Income Up To $9,875 Paid 10 Percent, While In 2022, That Income Bracket Rose To.

$19,400 for tax year 2022 and the agency recently announced the retirement plan contribution changes for. Irs announces tax brackets other inflation adjustments for 2022. Here we’ll go over the new irs federal tax brackets for the 2021 and 2022 tax years, how to figure out which ones you fall into, and give you a heads up about.

Taxable Income ($) Base Amount Of Tax ($) Plus Marginal Tax Rate Of The Amount Over Not Over Over ($) Single.

10% tax rate for incomes less than $20,550. For instance, a married couple filing a joint return with $100,000 of taxable income in 2022 won't pay $22,000 in tax just because their total taxable income falls within the 22% bracket for joint. These are the tax rates for married couples filing jointly.

10%, 12%, 22%, 24%, 32%, 35% And 37%.

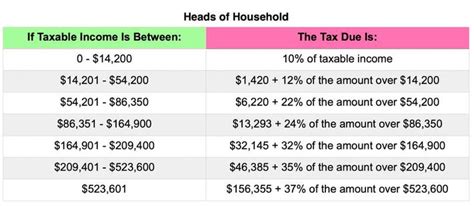

Your bracket depends on your taxable income and filing status. For instance, a married couple filing a joint return with $100,000 of taxable income in 2022 won't pay $22,000 in tax just because their total taxable income falls within the 22% bracket for joint. 2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below.

35%, For Incomes Over $215,950 ($431,900 For Married Couples Filing Jointly);

The 2022 tax brackets for married couples filing jointly. For married taxpayers filing jointly, they can use these new tax brackets to figure out how much tax they can expect to pay this coming tax season. Tax brackets are how the irs determines which income levels get taxed at which federal income tax rates.

In 2022, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table 1).

The top tax rate for individuals is 37 percent for taxable income above $539,901 for tax year 2022. 2021 federal income tax brackets. The indiana income tax has one tax bracket, with a maximum marginal income tax of 3.23% as of 2022.