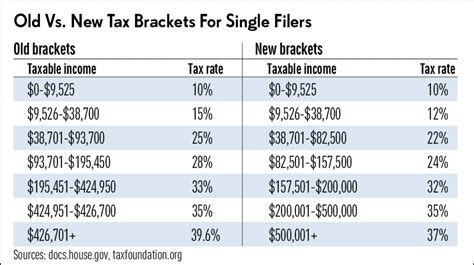

2022 Tax Brackets Single Vs Married. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Adjusting tax brackets for inflation is especially important this year, said garrett watson, senior policy analyst for the tax foundation.

In some cases, married couples will find themselves in a lower tax bracket now that they are combining incomes. 2022 federal income tax rates: Federal income tax brackets for 2021 (filed by april 18, 2022)

The Standard Deduction For Single Taxpayers And Married Individuals Filing Separately Rises To $12,950 For 2022.

At the same time, married individuals who file separately will pay income taxes according to the same brackets as single filers. Tax rate single filers married filing jointly married, filing separately head of household; Federal income tax brackets for 2021 (filed by april 18, 2022)

2022 Tax Brackets (Taxes Due April 2023 Or October 2023 With An Extension) Tax Rate Single Head Of Household Married Filing Jointly Or Qualifying Widow Married Filing Separately;

Married couples filing jointly : The standard deduction for the 2021 tax year, due april 15, 2022. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple (as opposed to filing separately as singles) based on 2022 federal income tax brackets and data specific to the united states.

The 2022 Standard Deduction Amounts Are As Follows:

There are still seven tax rates in effect for the 2022 tax year: Single tax brackets and standard deduction married tax brackets and standard deduction how to calculate federal tax liability a common misconception about federal tax liability and tax “brackets” is that once you enter a certain tax bracket, you pay the. The irs also announced that the standard deduction for 2022 was increased to the following:

In Some Cases, Married Couples Will Find Themselves In A Lower Tax Bracket Now That They Are Combining Incomes.

Tax rate for single filers for married individuals filing joint returns for heads of households; Single or married filing separately: 22% tax rate for incomes over $41,775 but not over.

2021 Federal Income Tax Brackets;

The additional standard deduction for people who have reached age 65 (or who are blind) is $1,400 for each married taxpayer or $1,750 for unmarried taxpayers. Adjusting tax brackets for inflation is especially important this year, said garrett watson, senior policy analyst for the tax foundation. In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to $10,275.