2022 Tax Brackets Single. Below are income tax rate tables by filing status, income tax bracket tiers, and a breakdown of taxes owed. The maximum credit is $3,733 for one child, $6,164 for two children, and $6,935 for three or more children.

The maximum credit is $3,733 for one child, $6,164 for two children, and $6,935 for three or more children. Married filing jointly or qualifying widow (er) 10%. These are the rates for taxes due in april 2023.

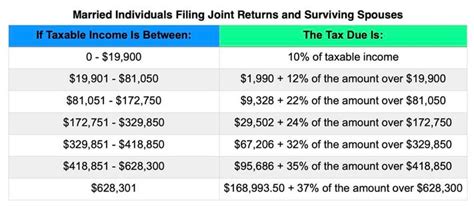

2022 Tax Brackets For Single Filers And Married Couples Filing Jointly.

22% tax rate for incomes over $41,775 but not over. Here’s how a sample tax calculation might work for a single adult making $60,000 per year in 2022 and taking the standard deduction: That’s a lot of money, but it’s still $35,928 less than if the 37% rate were applied as a flat rate on the entire $1 million (which would result in a $370,000 tax bill).

Married Filing Jointly Or Qualifying Widow (Er) 10%.

Take $4,807.50 (the amount of taxes the taxpayer owes on their first. For example, if you are single and your taxable income is $75,000 in 2022, your marginal tax bracket is 22%. The rateucator calculates what is outlined here for you.

Then Taxable Rate Within That Threshold Is:

Every state with an income tax as well as the irs support the single filing status. The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year. However, some of your income will be taxed at the lower tax brackets, 10% and 12%.

And For 2022, This Amount Has Increased.

The maximum earned income tax credit in 2022 for single and joint filers is $560 if the filer has no children (table 5). These are the rates for taxes due in april 2023. The total bill would be about $6,800 — about 14% of your taxable income, even though you're in the 22% bracket.

So, For Example, The Tax On $1 Million For A Single Person In 2022 Is $334,072.

The rest is taxed at lower rates as described above. In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to $10,275. 2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below.