Single Filing Tax Brackets 2022. $0 $10,275 $0 + 10.0 $0 $10,275 $41,775 $1,027.50 + 12.0 $10,275 $41,775 $89,075 $4,807.50 + 22.0 $41,775 $89,075 $170,050 $15,213.50 + 24.0 $89,075 $170,050 $215,950 $34,647.50 + 32.0 $170,050. These are the rates for taxes due in april 2023.

Taxable income (single) taxable income (married filing. The irs changes these tax brackets from year to year to account for inflation and other changes in economy. The total bill would be about $6,800 — about 14% of your taxable income, even though you're in the 22% bracket.

However, Some Of Your Income Will Be Taxed At The Lower Tax Brackets, 10% And 12%.

2022 federal tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator. The 2022 tax brackets for single filers. That 14% is called your effective tax.

The Additional Standard Deduction For People Who Have Reached Age 65 (Or Who Are Blind) Is $1,400 For Each Married Taxpayer Or $1,750 For Unmarried Taxpayers.

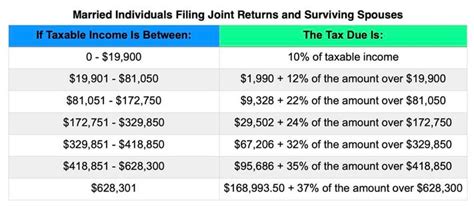

Cumulative tax from lower brackets (single filing) starting agi (joint filing) ending agi (joint filing) cumulative tax from lower brackets (joint filing) 1. Tax rate for single filers for married individuals filing joint returns for heads of households; 10% tax rate for incomes less than $10,275.

Here Is A Look At What The Brackets And Tax Rates Are For 2021 (Filing 2022):

For example, if you are single and your taxable income is $75,000 in 2022, your marginal tax bracket is 22%. Rate for unmarried individuals for married individuals filing joint returns for heads of households; If you’re single, only your 2022 income over $523,600 is taxed at the top rate (37%).

So, For Example, The Tax On $1 Million For A Single Person In 2022 Is $334,072.

It's likely this decision will affect you: However, the tax brackets are adjusted (or indexed) each year to account for inflation. The top tax rate for individuals is 37 percent for taxable income above $539,901 for tax year 2022.

Single Taxpayers And Married Individuals Filing Separately:

You can see also tax rates for the year 202 1. 10%, 12%, 22%, 24%, 32%, 35% and 37%. These are the rates for taxes due in april 2023.