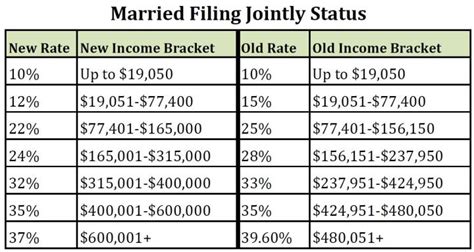

2022 Tax Brackets Married Joint. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. 2021 tax brackets and rates for single filers, married couples filing jointly, and heads of households;

2022 federal income tax brackets and rates. The irs changes these tax brackets from year to year to account for inflation and other changes in economy. 12% for incomes over $9,950 ($19,900 for married couples filing jointly).

2022 Tax Brackets (For Taxes Due In April 2023) Announced By The Irs On November 10, 2021, For Individuals, Married Filing Jointly, Married Filing Separately And Head Of Household Are Given Below.

In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to. Married filing jointly is the filing type used by taxpayers who are legally married (including common law marriage) and file a combined joint income tax return rather than two individual income tax returns. $83,551 magi for married couples.

Married Individuals Filling Joint Returns;

Over $20,550 but not over $83,550: The additional standard deduction for people who have reached age 65 (or who are blind) is $1,400 for each married taxpayer or $1,750 for unmarried taxpayers. However, the income limits for the tax brackets are.

Here Are The 2021 Tax Brackets According To The Irs.

The 2022 tax brackets affect the taxes that will be filed in 2023. 2022 married filing jointly tax brackets. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly.

12% For Incomes Over $9,950 ($19,900 For Married Couples Filing Jointly).

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. Normally, amt is taxed at a flat rate of 26%. The vast majority of taxpayers claim for the standard deduction, and this will increase by $800 for married couples filing jointly, as it rises from $25,100 in 2021 to $25,900 in 2022.

These Are The 2021 Brackets.

Individual single filers, married individuals filing jointly, heads of households, and married individuals filing separately: Single or married filing separately: If you can’t make $170,050 as a single person or $340,100 as a married couple, there’s a second ideal income amount for ultimate happiness and paying reasonable taxes.