2022 Tax Brackets Married. These are the rates for taxes due in april 2023. The standard deduction amount for the 2022 tax year jumps to $12,950 for single taxpayers, up $400, and $25,900 for a married couple filing jointly, up $800.

There are seven federal tax brackets for the 2022 tax year: Again, assuming you’re single with $90,000 taxable income in 2022, the first $9,950 of your income is taxed at the 10% rate for $995 of tax. In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to.

Normally, Amt Is Taxed At A Flat Rate Of 26%.

In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Every year the irs modifies the tax brackets for inflation. Tax rate (%) 2022 tax brackets.

2021 Tax Brackets (Due April 15, 2022) Tax Rate Single Filers Married Filing Jointly* Married Filing Separately Head Of Household;

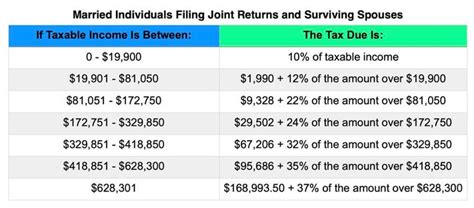

Your tax bracket depends on your taxable income and your filing status: Your specific bracket depends on your taxable income and filing status. For tax year 2022, the top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 ($647,850 for married couples filing jointly).

Again, Assuming You’re Single With $90,000 Taxable Income In 2022, The First $9,950 Of Your Income Is Taxed At The 10% Rate For $995 Of Tax.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. The standard deduction amount for the 2022 tax year jumps to $12,950 for single taxpayers, up $400, and $25,900 for a married couple filing jointly, up $800. 2022 federal income tax rates:

2021 Tax Brackets And Rates For Single Filers, Married Couples Filing Jointly, And Heads Of Households;

Here are four charts i created for the 2022 income tax brackets for singles and for married couples. $12,950 for single filers (up $400) $12,950 for married taxpayers who file their taxes separately (up $400) $19,400 for heads of households (up $600) $25,900 for married taxpayers who file jointly (up $800) These are the rates for taxes due in april 2023.

3.8% Tax On The Lesser Of:

35%, for incomes over $215,950 ($431,900 for married couples filing jointly); In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to. Generally, as you move up the pay scale, you also move up the tax scale.