2022 Tax Brackets Joint. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. Below are some of the most common deductions and exemptions americans can take.

The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year. Below are some of the most common deductions and exemptions americans can take. Then taxable rate within that threshold is:

When It Comes To Calculating How Much You Owe In Taxes For These Gains, A Lot Depends On How Long You Were Holding The.

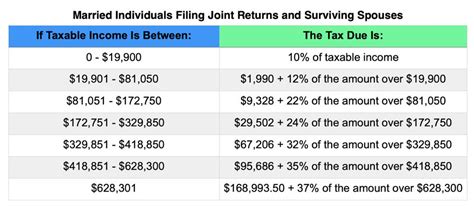

2022 tax brackets for single filers and married couples filing jointly tax rate taxable income (single) taxable income (married filing jointly) 10% up to $9,950 up to $19,900 12% $9,951 to $40,525 $19,901 to $81,050 22% $40,526 to $86,375 $81,051 to $172,750 24% $86,376 to $164,925 $172,751 to $329,850 32% $164,926 to $209,425 $329,851 to. Tax rate for single filers for married individuals filing joint returns for heads of households; The top tax rate for individuals is 37 percent for taxable income above $539,901 for tax year 2022.

The Standard Deduction Amount For The 2022 Tax Year Jumps To $12,950 For Single Taxpayers, Up $400, And $25,900 For A Married Couple Filing Jointly, Up $800.

Below are some of the most common deductions and exemptions americans can take. These are the rates for taxes due in april 2023. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Without Further Ado, Here Are The 2022 Tax Brackets According To Your Filing Status And Income From The Irs.

2022 married filing jointly tax brackets. Then taxable rate within that threshold is: All net unearned income over a threshold amount of $2,300 for 2022 is taxed using the brackets and rates of the child’s parents 2022 tax rate schedule standard deductions & personal exemption filing status standard deduction personal exemption phaseouts begin at agi of:

There Are Seven Federal Tax Brackets For The 2022 Tax Year:

The additional standard deduction for people who have reached age 65 (or who are blind) is $1,400 for each married taxpayer or $1,750 for unmarried taxpayers. Married individuals filling joint returns; The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly.

Single $12,950 N/A N/A Head Of Household.

2021 tax brackets and rates for single filers, married couples filing jointly, and heads of households; In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Cumulative tax from lower brackets (single filing) starting agi (joint filing) ending agi (joint filing) cumulative tax from lower brackets (joint filing) 1.