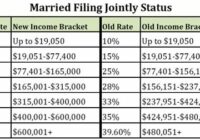

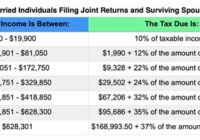

2022 Tax Brackets Married Joint

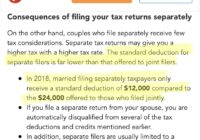

2022 Tax Brackets Married Joint. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. 2021 tax brackets and rates for single filers, married couples filing jointly, and heads of households; Tax Table 2022 Ca E Jurnal from ejurnal.co.id 2022… Read More »