Joint Filing Tax Brackets 2022. According to a house ways and means committee staffer, taxpayers who earn more than $400,000 (single), $425,000 (head of household), or $450,000 (married joint) will be subject to the highest federal tax rate beginning in 2022. 2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below.

Single or married filing separately: Without further ado, here are the 2022 tax brackets according to your filing status and income from the irs. $19,400 for tax year 2022

$19,400 For Tax Year 2022

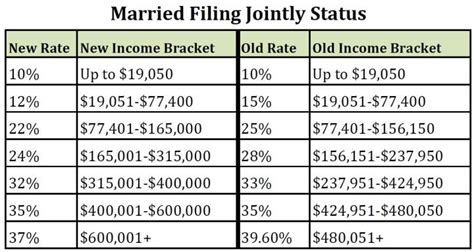

Single or married filing separately: 2021 tax brackets and rates for single filers, married couples filing jointly, and heads of households; 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Tax Rate For Single Filers For Married Individuals Filing Joint Returns For Heads Of Households;

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. The irs recently announced the new tax brackets for the 2021 tax year, to be filed in 2022. There are seven federal income tax rates in 2022:

2022 Tax Brackets For Single Filers And Married Couples Filing Jointly Tax Rate Taxable Income (Single) Taxable Income (Married Filing Jointly) 10% Up To $9,950 Up To $19,900 12% $9,951 To $40,525 $19,901 To $81,050 22% $40,526 To $86,375 $81,051 To $172,750 24% $86,376 To $164,925 $172,751 To $329,850 32% $164,926 To $209,425 $329,851 To.

35% for incomes over $215,950 single & $431,900 for married/joint filing. The rate would kick in for single filers with income over $400,000, heads of household over $425,000, married joint filers over $450,000, and married separate filers over $225,000. Federal income tax brackets and rates for 2022.

Filing Jointly Has Many Tax Benefits, As The Irs And Many States Effectively Double The Width Of Most Mfj Brackets When Compared To The Single Tax Bracket At The Same.

According to a house ways and means committee staffer, taxpayers who earn more than $400,000 (single), $425,000 (head of household), or $450,000 (married joint) will be subject to the highest federal tax rate beginning in 2022. The irs also tweaked the marginal tax rates, often referred to as tax brackets, for the year ahead. There are still seven brackets broken up by income.

They'll Be Taxed At 10%.

The additional standard deduction for people who have reached age 65 (or who are blind) is $1,400 for each married taxpayer or $1,750 for unmarried taxpayers. The irs also announced that the standard deduction for 2022 was increased to the following: 32% for incomes over $170,050 ($340,100 for married couples filing jointly);