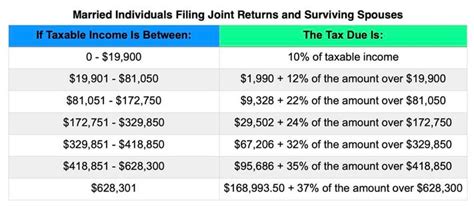

2022 Tax Filing Brackets. The irs isn't the irs website defines the new tax brackets as follows: There are seven tax brackets for most ordinary income for the 2022 tax year.

2021 tax brackets and rates for single filers, married couples filing jointly, and heads of households; As you can see from the chart, the biggest income tax rate jump goes from 24% to 32% when your income is between $170,051 to $215,950. There are seven tax brackets for most ordinary.

Rate For Unmarried Individuals For Married Individuals Filing Joint Returns For Heads Of Households;

10 announced new tax brackets for the 2022 tax year, for taxes you’ll file in april 2023, or october 2023 if you file an extension. Kentucky, illinois, and tennessee tornado victims have until may 16, 2022 to file 2021 individual income tax returns,. For 2022, they're still set at 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Listed Below Are The 2022 Tax Brackets, According To Your Filing Status And Income.

Tax rate for single filers for married individuals filing joint returns for heads of households; Federal income tax brackets 2022. The irs changes these tax brackets from year to year to account for inflation and other changes in economy.

2021 Tax Brackets And Rates For Single Filers, Married Couples Filing Jointly, And Heads Of Households;

In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to. However, the tax brackets are adjusted (or indexed) each year to account for inflation. Tax filing deadline to request an extension until oct.

You Can See Also Tax Rates For The Year 2021 And Tax.

The tax rates will not change. Tax brackets are not as intuitive as they seem because most taxpayers have to look at more than one bracket to. $19,400 for tax year 2022;

The Internal Revenue Service Is Adjusting Tax Brackets For The 2022 Tax Year, Which Culminates On Tax Day, Friday, April 15, 2022.

As you can see from the chart, the biggest income tax rate jump goes from 24% to 32% when your income is between $170,051 to $215,950. 2022 tax brackets for single filers, married couples filing jointly, and heads of households; Without further ado, here are the 2022 tax brackets according to your filing status and income from the irs.