Income Tax Brackets 2022 Married Filing Jointly. The irs also announced that the standard deduction for 2022 was increased to the following: 2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below.

According to a house ways and means committee staffer, taxpayers who earn more than $400,000 (single), $425,000 (head of household), or $450,000 (married joint) will be subject to the highest federal tax rate beginning in 2022. Single filers & married couples filing separately. Phaseout ends (credit equals zero) $27,380:

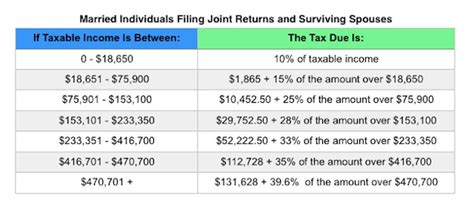

Irs Tax Brackets For Married Couples Filing Jointly:

For the tax year 2021, the maximum tax rate for individual single taxpayers with earnings over $523,600 ($628,300 for married couples filing jointly) remains 37 percent. You can see also tax rates for the year 202 1. The irs isn't changing the percentages people will pay 10% for incomes of $10,275 or less ($20,550 for married couples filing jointly, $14,650 for heads of household).

The Top Tax Rate For Individuals Is 37 Percent For Taxable Income Above $539,901 For Tax Year 2022.

2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below. Married filing jointly is the filing type used by taxpayers who are legally married (including common law marriage) and file a combined joint income tax return rather than two individual income tax returns. The irs also announced that the standard deduction for 2022 was increased to the following:

California Tax Brackets 2022 Married Filing Jointly, Irs Tax.

$12,950 for single filers (up $400) $12,950 for married taxpayers who file their taxes separately (up $400) $19,400 for heads of households (up $600) $25,900 for married taxpayers who file jointly (up $800) Single filers & married couples filing separately. $83,551 magi for married couples.

The Second Ideal Income Amounts Based On 2022 Income Tax Brackets.

Phaseout ends (credit equals zero) $27,380: 10% of the taxable income : If successful, the highest marginal income tax rate would increase from 37% to 39.6%.

The Irs Changes These Tax Brackets From Year To Year To Account For Inflation And Other Changes In Economy.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. 32% for incomes over $170,050 ($340,100 for married couples filing jointly); The other rates are as follows: