2022 Tax Brackets Married Filing Jointly California. The 2022 california state tax brackets. 2022 tax brackets married filing jointly december 3, 2021 november 27, 2021 by brian a.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and. February 9, 2021october 4, 2021·tax bracket ratesby admin. 2022 tax brackets married filing jointly december 3, 2021 november 27, 2021 by brian a.

The California Married Filing Jointly Filing Status Tax Brackets Are Shown In The Table Below.

In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Here are the rates and brackets for the 2021 tax year, which you'll file. The amt exemption amount for 2022 is $75,900 for singles and $118,100 for married couples filing jointly (table 3).

2022 California Tax Tables With 2022 Federal Income Tax Rates, Medicare Rate, Fica And Supporting Tax And Withholdings Calculator.

These income tax brackets and rates apply to california taxable income earned january 1, 2020 through december 31, 2020. The top tax rate for individuals is 37 percent for taxable income above $539,901 for tax year 2022. The past ten years have seen a drastic decrease in canadian tax rates.

2022 Federal Income Tax Brackets And Rates.

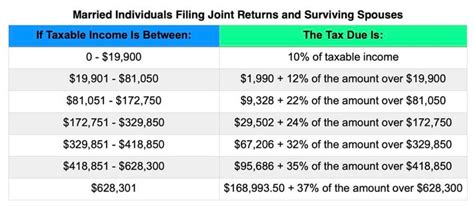

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. 15% tax rate up to. Then taxable rate within that threshold is:

35%, For Incomes Over $215,950 ($431,900 For Married Couples Filing Jointly);

2022 federal income tax brackets and rates. Married filing jointly is the filing type used by taxpayers who are legally married (including common law marriage) and file a combined joint income tax return rather than two individual income tax returns. Married individuals filling joint returns;

It Is The Smallest Tax Bracket In Canada And Applies To The Taxable Earnings Of The Individual Or The Company.

The money an individual pays tax to the government each year is then sent to the nearest social development canada office for. In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to. California has nine tax brackets: