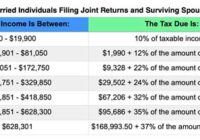

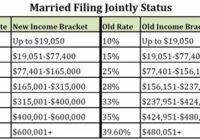

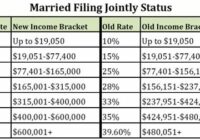

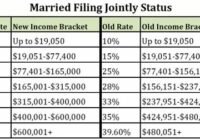

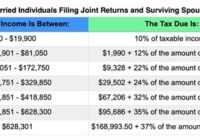

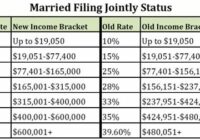

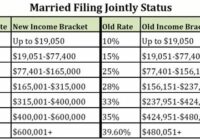

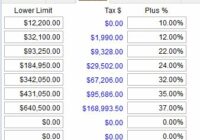

Irs Tax Brackets 2022 Married Jointly

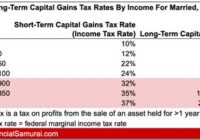

Irs Tax Brackets 2022 Married Jointly. The 2022 tax brackets affect taxes that will be filed in. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. 2022 Tax Brackets Irs Mfj E Jurnal from ejurnal.co.id Tax rate (%) 2022… Read More »