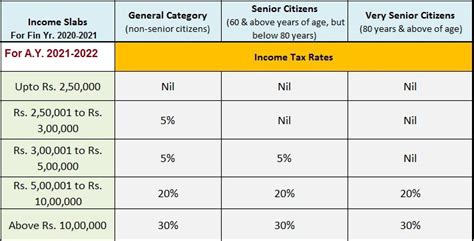

Income Tax Slab 2021 To 2022. Income tax slab rate for individuals opting for old tax regime. 242 per week 1048 per month 12570 per year.

10,00,000 20% 20% above rs. Income tax slab rate for individuals opting for old tax regime. 7% if total income is more than rs.

Therefore Tax Rate And Slabs Will Remain Unchanged For Tax Year Starting From July 01, 2021.

Income tax slab rate for individuals opting for old tax regime. Where taxable income does not. 7% if total income is more than rs.

Payhr Income Tax Calculator Is An Simple Online Tax Calculator Tool That Helps You To Estimate Your Tax Based On Your Income.

The current tax year is from 6 april 2021 to 5 april 2022. For those who wish to claim it deductions and exemptions. 1 crore but less than rs.

Marginal Relief Will Also Apply For Firms With Incomes Where The Surcharge Exceeds Their Excess Income.

Following are tax slabs for the taxable income and rate of tax applicable on salaried persons for the tax year 2022 (july 01, 2021 to june 30, 2022). To know more on new tax regime, call ebizfiling at +919643203209. 12% if total income exceeds rs.

10,00,000 30% Individuals (Senior Citizen) Net Income Rate Of Income Tax Up To Rs.

The slab rates change from time to time, considering different income levels and the basic standard. Tax rates on salary income tax year 2022. Income tax saving guidelines for employee's.

Super Senior Citizen (Who Is 80 Years Or More At Any Time During The Previous Year) Net Income Range:

10,00,000 20% 20% above rs. The finance bill 2021 has not proposed changes to tax rates and slabs for salaried persons for tax year 2022, sources in the federal board of revenue (fbr) said. Following is the table for tax rates on taxable income of salaried persons prevailed during tax.