Iras Tax Calculator Ya 2022. Singapore’s personal income tax rate ranges from 0% to 22%. Singapore income tax calculator 2022/23.

You can also select future and historical tax years for additional income tax calculations (where. A further 50% exemption on the next $290,000 of normal chargeable income*. Hern yee wong january 3, 2022 january 6, 2022.

Key In Your Gross Employment Income Over The Past Year Along With Any Bonuses, Fixed Allowances And Any Benefits In Kind That You Have Generated.

You can also select future and historical tax years for additional income tax calculations (where. * normal chargeable income refers to income to be taxed at the prevailing corporate income tax rate of 17%. Income tax calculator for tax resident individuals dividends interest royalty, charge, estate/trust income gains or profits of an income nature net tax payable net employment income approved donations.

Filing For The Year Of Assessment (Ya) 2022 Begins On 1 Mar 2022.If You Need To Submit An Income Tax Return, Please Do So By The Following.

A further 50% exemption on the next $290,000 of normal chargeable income*. Aa = 75% of cost. Each income tax calculator allows for employment income, expenses, divided, business and personal activity, everything you will require to calculate your income tax return for 2022/23.

Employers Specified Under Paragraph 3 Of The Gazette (Pdf, 399 Kb) Must Submit Their Employees’ Income Information To Iras Electronically By 1 Mar Every Year.

Download the required tax forms from the iras website to check what information is required. Filing your singapore corporate tax. Hern yee wong january 3, 2022 january 6, 2022.

Do Not Exclude The Cpf Employee Portion When You Key In This Figure.

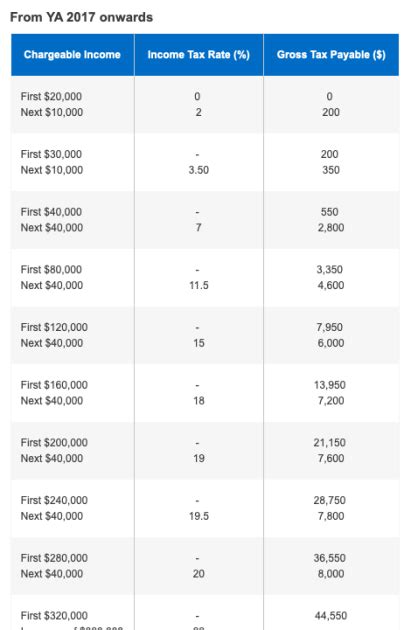

Ya 2021 'ya 2021'!a100000 'ya 2021'!print_area. Please refer to how to calculate your tax for more details. More details about singapore resident tax rates can be found here.

The First $100,000 Will Be At 4.25% Followed By The Next $100,000 Will Be At 8.5%, Thereafter Income Above $200,000.

On the first $10,000 of normal chargeable income, there is a 75% exemption; You may also use the tax calculator for resident individuals (xls, 96kb) to estimate your tax payable. In the united states, an ira (individual retirement account) is a type of retirement plan with taxation benefits defined by irs publication 590.