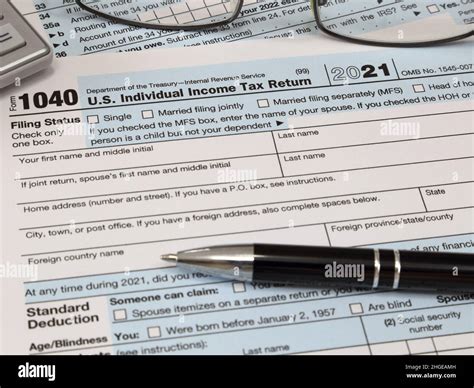

Irs Tax Filing Deadline For 2022. Filing deadline for tax year 2021. Deadline for employees who earned more than $20 in tip income in february to.

By law, washington, d.c., holidays impact tax deadlines for everyone in the same way federal holidays do. 2022 tax deadline for 2021 tax returns. Deadline for farmers and fishermen to file individual income tax returns unless they paid 2021 estimated tax by jan.

The New Filing Deadline Has Been Extended To May 16, 2022.

A similar occurrence is visible in maine and massachusetts due to patriots’ day on april 18. Please see irs publication 509 for a full list of important filing dates. Third estimated tax payment for 2022 due.

Deadline For Employees Who Earned More Than $20 In Tip Income In February To.

People should keep this and any other irs letters about advance child tax credit payments with their tax records. That's because april 15 is recognized as a holiday, emancipation day , in washington, dc. Estates & trusts (form 1041) april 15, 2022.

Typically, The Deadline To File And Pay Taxes Is April 15;

In 2022, monday, april 18, rather than april 15, is the irs filing deadline by which individual income tax returns must be postmarked. For the year 2021, s corp tax returns are due on march 15th, 2022. The 2021 efile tax season starts in january 2021.

Deadline For Farmers And Fishermen To File Individual Income Tax Returns Unless They Paid 2021 Estimated Tax By Jan.

With emancipation day falling on the 15th, the deadline has been extended to april 18. Start to prepare and efile your 2021 tax return (s). You need to either file your tax return 1120s by this date or request for an extension by filing form 7004 with the irs.

The Deadline For Filing Federal Taxes For Most Taxpayers Is Monday, April 18, 2022.

Please note that irs will only grant an extension if you have timely filed your previous years tax returns. The extension is being offered to people living in illinois, kentucky and tennessee. For example if you didn’t file your 2020, you will not be able to get extension.