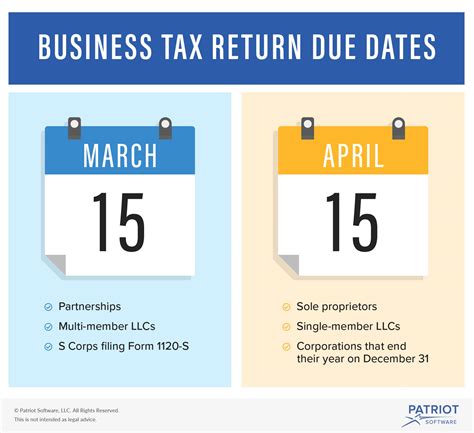

Llc Tax Return Due Dates. Form 1065 is due on the 15th day of the third month after the partnership’s tax year ends. Tax due dates for partnership & s.

May 17, 2021 partnership tax returns on form 1065: Their taxable income is then subject to a 21% flat corporate income tax rate. An llc that does not want to accept its default federal tax classification, or that wishes to change its classification, uses form 8832, entity classification election pdf, to elect how it will be classified for federal tax purposes.

Irs Form 1120 Is Used For C Corporation Income Tax Returns.

25, which is christmas day (a federal legal holiday). You do not need to file any separate paperwork for the llc itself. The extended deadline is oct.

15Th Day Of The 4Th Month After The Beginning Of Your Tax Year.

This form is due on the 15th day of the 3rd month after the end of the corporation's tax year. Tax return due date for llc. When a reporting due date happens to fall on saturday, sunday, or a legal holiday, the reporting due date becomes the next business day.

Generally, An Election Specifying An Llc’s Classification Cannot Take Effect More Than 75 Days Prior To The Date The Election Is Filed, Nor.

The fourth quarter estimated tax payments are due by dec. All of the income and expenses from your llc are reported on your personal tax return, which is due on april 15. All of the income and expenses from your llc are reported on your personal tax return which is due on april 15.

For Example, For Reports Normally Due On The 25Th Of The Month, The Due Date Is Dec.

Llc members who must make estimated tax payments on their share of income should pay them four times a year. Tax due dates for partnership & s. However business owners must pay any estimated taxes by the original deadline to avoid interest and penalties on overdue tax payments.

This Article Will Walk You Through The Tax Year 2021 Due Dates For Partnerships That You Need To Keep An Eye Out For This Year.

However, if these dates fall on a saturday, sunday, or legal holiday in any given year, the payments are due the next business day. If you file an extension for your corporate tax return, form 5472 is due together with the tax return on october 15. What date are llc taxes due: