There are some new stimulus checks, and another child tax credit payment of up to $1,800 to come in april, while we outline below the other benefits, as well as the changes to cola and medicare. If you have not received the stimulus 1 and/or stimulus 2 payments, you can claim them via the recovery rebate credit on your 2020 tax return.

Stimulus Check 3 March Recovery Rebate Or Stimulus Payment

If you're still waiting on a.

Stimulus check 3 tax year. Who is eligible to still get the 3rd stimulus check or child tax credit in 2022. As a result of the coronavirus pandemic, the us government has launched three stimulus check payments during 2020 and 2021. The irs uses 2019 or 2020 tax returns to determine eligibility for your third stimulus check.

Find out how to claim it on your 2021 tax return. To do this, you'll need to enter your banking information when you file your 2021 taxes this year. However, many were ensnared for months by the.

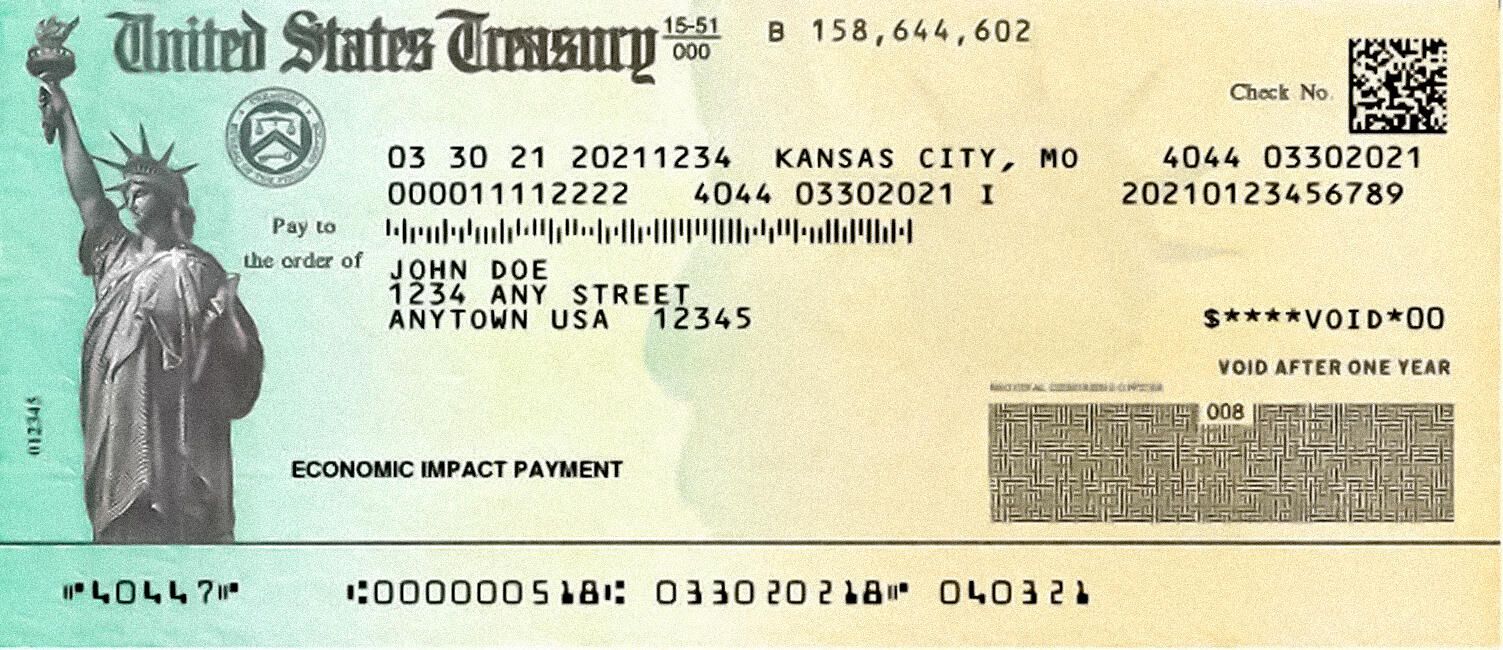

Paper checks are sent out depending on the last three digits of your zip code on your tax return. The irs will send two letters to taxpayers in 2022 who were qualified for either the third stimulus check or the monthly advance child tax credit in 2020. The economic impact payment (eip), cares act, or stimulus check payment one was launched in april of 2020.

There are some new stimulus checks, such as the 6,300 dollar check to students in atlanta, while we outline below the other benefits, as well as the upcoming changes to cola and medicare. The 2022 tax season officially begins on january 24. American rescue plan approved in march 2020 permitted most citizens to.

16 march 2021 00:12 edt Also, for filers who got a third economic impact payment, sometimes referred to as a stimulus check, the irs states it will mail you letter 6475. Californians were required to file their 2020 tax returns by october 15 to be eligible for the check.

The third round of stimulus checks are based on your most recent tax filing with the irs but are an advanced payment on a refundable tax credit for 2021. Who gets a 3rd stimulus check? Those who received some but not all of their stimulus checks may use the recovery rebate credit, which allows filers to deduct the amount they did not receive to owed taxes.

The third stimulus check, formally known as an economic impact payment, was a product of the american rescue plan, which was enacted in march 2021. Most americans who were eligible for the third stimulus check did eventually receive them. That means in 2020, it cost taxpayers roughly $23.3 million for paper check refunds to be sent out and about $10.2 million for direct deposit.

Latest on push for one group to get 4th stimulus check if you’re getting ready to file your 2021 tax return, click here for steps you can take to make filing easier. According to the irs, nearly $390 billion in third stimulus payments had been sent to americans as of june 2021. Until the end of january, they’ll be here.

Do you qualify for stimulus check one? Which tax return is used for my third stimulus check? You should note that if your income fell in the 2020 tax year, filing your tax return earlier could help you qualify for a bigger third stimulus check.

The eitc “lookback” credit can be huge for families in lowering their 2021 tax bill. As with the first two rounds of payments, your third stimulus check is actually just an advanced payment of the recovery rebate tax credit for the 2021 tax year. Americans who were eligible for the third stimulus check or the monthly advance child tax credit in 2021 need to be on the lookout for.

For a family with three children, it can amount to up to $6,700. You can not claim the stimulus 3 payment on your 2020 tax return, but the irs did rely on your 2019 and/or 2020 tax return(s) when calculating your stimulus 3 payment. Errors to work on fixing now

The irs issued more than 169 million payments in the third round of direct stimulus aid, with the $1,400 checks reaching most american households. Individuals who have an adjusted gross income (agi) of up to $75,000, heads of household with an agi of up to $112,500, and married couples with an agi of up to $150,000 per year qualify for the entire stimulus check amount, which is $1,400 for individuals and $2,800 for heads of household and married couples filing. And if you're still waiting on the third stimulus check money to.

The irs has turned its attention to tax filing season now that it has sent all legally permitted stimulus checks. Unemployment benefits expire for millions 05:49.

Third Stimulus Check For Senior Citizens Takeaway For

Another 2.2 Million 1,400 Stimulus Checks Have Gone Out

Your Third Stimulus Check Could Be Much Bigger If You File

Stimulus check 2021 What to do if you must file a tax return

21+ Stimulus Check Envelope 2020 PNG

1040 Us Individual Tax Return Form With Stimulus Check

A bonus stimulus check may be on the way if you filed your

The Second Stimulus Check and Your Tax Return What NO

Can you lose stimulus checks if you don't file taxes

More stimulus checks are coming in the mail. 2 ways you

Stimulus Tracker / irs get my payment tool The irs has

How you can lose your 1,400 stimulus check by filing

Do this ASAP if you still haven’t gotten your 600

A bonus stimulus check may be on the way, thanks to your

How To Claim Stimulus Check 2021 Turbotax Don't Qualify

How To Know If I Qualify For Stimulus Check 2021

Stimulus Check When Is It Coming thejewelrydesignersresource