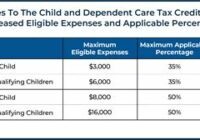

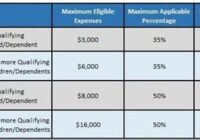

Does The Child And Dependent Care Phase Out

Does The Child And Dependent Care Phase Out. The 2021 child and dependent care credit amount begin to phase out when the taxpayer’s adjusted gross income (agi) reaches over $125,000. A single taxpayer with one child won’t receive a credit once their modified adjusted gross income (magi) is $240,000, but a single taxpayer with two. An Adventure Begins… Read More »