Child Care Credit 2022 Income Limit

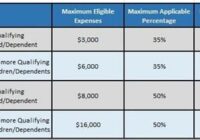

Child Care Credit 2022 Income Limit. There is no income limit for claiming the child care credit. The maximum amount you can put into your dependent care fsa for 2022 is $5,000 for individuals or married couples filing jointly, or $2,500 for a married person filing separately. 2021 Index Figures Broker World from brokerworldmag.com How is the child… Read More »