2022 Tax Brackets And Standard Deduction

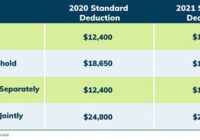

2022 Tax Brackets And Standard Deduction. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of. Single or married filing separately: 2021 Tax Brackets and Other IRS Tax Changes Tax Defense from www.taxdefensenetwork.com The 2022 standard deduction amounts are as follows: The tax year 2022 individual income… Read More »