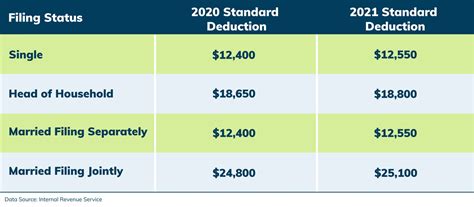

2022 Tax Brackets And Standard Deduction. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of. Single or married filing separately:

The 2022 standard deduction amounts are as follows: The tax year 2022 individual income tax standard deductions are: The standard deduction and the tax brackets for 2022 are announced when the irs publishes the agency’s inflation and changes to the cost of living statistics.

The Additional Standard Deduction For People Who Have Reached Age 65 (Or Who Are Blind) Is $1,400 For Each Married Taxpayer Or $1,750 For Unmarried Taxpayers.

2022 standard deduction and personal exemption. Tax rates report offers an early projection of deductions, limitations, upward changes to tax brackets thresholds. $5.75+.67 percent for taxable income between $1,743 and $3,486;

You Deduct An Amount From Your Income Before You Calculate Taxes.

In the case of corporate income taxation, the tax bracket applicable to corporations is the 15 percent tax bracket. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600. The standard deduction and the tax brackets for 2022 are announced when the irs publishes the agency’s inflation and changes to the cost of living statistics.

$5,450 For Married Taxpayers Filing Jointly;

Tax year 2022 income tax brackets are shown in the table below. The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of. For 2022, the limit is $1,150 or your earned income plus $400, whichever is greater.

For Tax Year 2022, The State’s Individual Income Tax Brackets Will Change By 3.115 Percent From Tax Year 2021.

Each year, the irs updates the existing tax code numbers for items that are indexed for inflation. If you’ve been following the news, the cpi (consumer price index) was 6.2% for inflation for october, which was the biggest increase in 30 years. The other ~10% itemize deductions when their total deductions exceed the standard deduction.

Again, It Can Never Be Greater Than The Normal Standard Deduction Available For.

This announcement is usually made before the new tax year begins. The 2022 standard deduction amounts are as follows: With our tax system, your income is reduced by your deductions.