2022 Federal Tax Brackets And Standard Deduction. The standard deduction is an amount every taxpayer is allowed to take as a deduction from their income to reduce their taxable income. The total deduction cannot be greater than the regular standard deduction amount of $12,950.

The total deduction cannot be greater than the regular standard deduction amount of $12,950. Bloomberg tax & accounting has projected the following standard deduction amounts for 2022: For heads of households, the standard.

The Annual Exclusion For Federal Gift Tax Purposes Jumps To $16,000 For 2022, Up From $15,000 In 2021.

Final 2022 tax brackets have now been published by the irs and as expected (and projected) federal tax brackets have expanded, while federal tax rates stayed the same. The standard deduction is an amount every taxpayer is allowed to take as a deduction from their income to reduce their taxable income. The next dollar you earn is taxed at 22%.

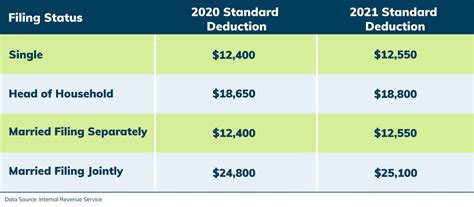

The Standard Deduction Increased Over 3% For All Filing Status’.

However, the level of taxable income that applies to each tax rate will increase. 10%, 12%, 22%, 24%, 32%, 35%, and 37%. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600.

The Irs Also Announced That The Standard Deduction For 2022 Was Increased To The Following:

You don’t pay federal income tax on every dollar of your income. Irs announces tax brackets and other inflation adjustments for tax year 2022 the 2022 standard deduction for married filing jointly is $25,900 You deduct an amount from your income before you calculate taxes.

There Are Seven Federal Income Tax Rates In 2022:

10 percent, 12 percent, 22 percent, 24. The standard deduction for single taxpayers and married individuals filing separately rises to $12,950 for tax year 2022, up $400 from tax year 2021. About 90% of all taxpayers take the standard deduction.

The Federal Estate Tax Exemption For Decedents Dying In 2022 Will Increase To $12.06 Million Per Person Or $24.12 Million For A Married Couple.

The other ~10% itemize deductions when their total deductions exceed the standard deduction. 2022 tax brackets and rates in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). For the 2022 tax year, the standard deduction amounts are as follows: