2022 Tax Brackets Federal. 15% on the first $49,020 of taxable income, and. 2022 federal income tax brackets and rates in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Tax brackets for 2022 there are seven federal tax brackets for the 2022 tax year: 2021, 2022 tax brackets by filing status. Federal income tax brackets were last changed one year ago for tax year 2021, and the tax rates were previously changed in 2018.

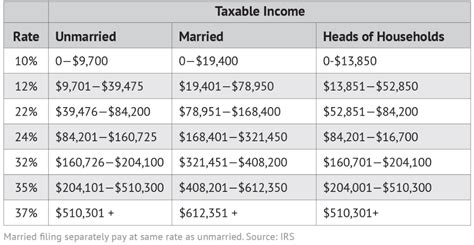

Tax Rate For Single Filers For Married Individuals Filing Joint Returns For Heads Of Households;

There are seven tax brackets for most ordinary income for the 2022 tax year: In between, you can pay 12 percent, 22 percent, 24 percent, 32 percent, and 35 percent of your taxable earnings in federal income taxes. 20.5% on the portion of taxable income over $49,020 up to $98,040 and.

Taxable Income ($) Base Amount Of Tax ($) Plus Marginal Tax Rate Of The Amount Over Not Over Over ($) Single.

Suppose you’re single and had $90,000 of taxable income in 2022. In tax year 2020, for example, a single person with taxable income up to $9,875 paid 10 percent, while in 2022, that income bracket rose to $10,275. There are seven federal income tax rates in 2022:

Below Are Income Tax Rate Tables By Filing Status, Income Tax Bracket Tiers, And A Breakdown Of Taxes Owed.

These are the rates for taxes due. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,950 for 2022, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600. The following are the federal tax rates for 2022 according to the canada revenue agency (cra):

This Means That These Brackets Applied To All Income Earned In 2021, And The Tax Return That Uses These Tax Rates Was Due In April 2022.

2022 federal income tax rates: See irs taxable income thresholds for previous tax brackets for back taxes or future, 2022 brackets. Tax rates and brackets tables for tax year 2021.

The Standard Deduction Increased Over 3% For All Filing Status’

2022 federal tax deduction amounts 2022 tax brackets (taxes due april 2023 or october 2023 with an extension) tax rate The rateucator calculates what is outlined here for you.