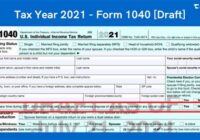

Irs Tax Deductions 2022

Irs Tax Deductions 2022. How to itemize deductions for the 2022 tax season a deduction cuts the income you're taxed on. This added standard deduction amount goes to $1,750 next year if the individual also is unmarried and not a surviving spouse. IRS Releases 2022 HSA Contribution Amounts and Excepted from www.benepro.com The standard deduction gets adjusted regularly… Read More »