2022 Tax Brackets Deductions. 12% on the next $29,774 = $3,572.88. For single taxpayers and married individuals filing separately, the standard deduction has risen to $12,950.

The additional standard deduction for those age 65 and over or the blind is $1,400 for 2022 or $1,750 if the taxpayer is also unmarried and not a surviving spouse. This is a $400 increase. The standard deduction amount for the 2022 tax year jumps to $12,950 for single taxpayers, up $400, and $25,900 for a married couple filing jointly, up $800.

The 2022 Standard Deduction Amounts Are As Follows:

The irs has released its 2022 tax brackets (a bracketed rate table for the irs federal income tax rates) and standard deduction amounts, and there are a number of inflation adjustments over the 2021 tax brackets and standard deductions. 2022 standard deduction and personal exemption. The standard deduction will increase by $400 for single filers and by $800 for joint filers (table 2).

All Net Unearned Income Over A Threshold Amount Of $2,300 For 2022 Is Taxed Using The Brackets And Rates Of The Child’s Parents 2022 Tax Rate Schedule Standard Deductions & Personal Exemption Filing Status Standard Deduction Personal Exemption Phaseouts Begin At Agi Of:

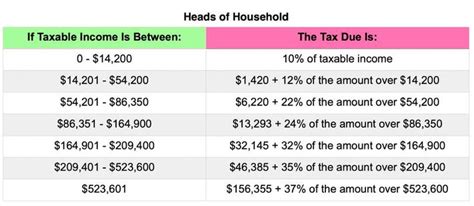

Single or married filing separately: You should also note that the standard deduction will rise to $12,950 for single filers for the 2022 tax year, from $12,550 the previous year. Federal income tax brackets for 2022 tax season a tax bracket is a range of incomes subject to a certain tax rate, which is determined by your filing status and taxable income for the year.

2022 Standard Deduction And Personal Exemption.

Individuals who are both aged and blind may receive both standard deductions increases. For 2022, assuming no changes, ellen’s standard deduction would be $14,700. Inflation,” said jean mccormick, vice president,.

The Personal Exemption For 2022 Remains At $0 (Eliminating The Personal Exemption Was Part Of.

This is a $400 increase. The personal exemption for 2022 remains at $0 (eliminating the personal exemption was part of the tax cuts and jobs act of 2017 (tcja). In order to keep up with inflation, tax brackets are adjusted.

The Next Dollar You Earn Is Taxed At 22%.

22% on the last $10,526 = $2,315.72. The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year. The additional standard deduction for those age 65 and over or the blind is $1,400 for 2022 or $1,750 if the taxpayer is also unmarried and not a surviving spouse.