2022 Tax Brackets Us. You may also be interested in using our free online 2022 tax calculator which automatically calculates your federal and state tax return for 2022 using the 2022 tax tables (2022 federal income tax rates and 2022 state tax tables). 2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below.

2022 tax bracket and tax rates. You can see also tax rates for the year 202 1 and tax bracket for the year 20 20on this site. Irs income tax forms, schedules and publications for tax year 2022:

The Irs Also Announced That The Standard Deduction For 2022 Was Increased To The Following:

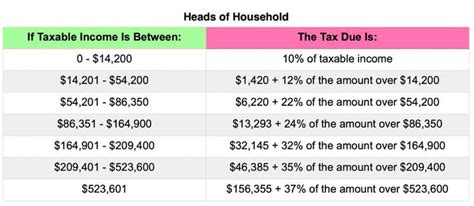

35% for incomes over $209,425 ($418,850 for married couples filing jointly). Tax rate for single filers for married individuals filing joint returns for heads of households; In the american tax system, income tax rates are graduated, so you pay different rates on different amounts of taxable income, called tax brackets.

Federal Income Tax Brackets Were Last Changed One Year Ago For Tax Year 2021, And The Tax Rates Were Previously Changed In 2018.

For example, a single taxpayer will pay 10 percent on taxable income up to $9,950 earned in 2021. 10%, 12%, 22%, 24%, 32%, 35% and 37%. The tax rates will not change.

Federal Income Tax Brackets 2022.

For tax year 2022, the top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 ($647,850 for married couples filing jointly). Irs income tax forms, schedules and publications for tax year 2022: There are seven tax brackets for most ordinary income for the 2022 tax year:

The Top Tax Rate For Individuals Is 37 Percent For Taxable Income Above $539,901 For Tax Year 2022.

The more you make, the more you pay. You may also be interested in using our free online 2022 tax calculator which automatically calculates your federal and state tax return for 2022 using the 2022 tax tables (2022 federal income tax rates and 2022 state tax tables). 37% for incomes over $523,600 ($628,300 for married couples filing jointly).

35%, For Incomes Over $215,950 ($431,900 For Married Couples Filing Jointly);

Calculate your income tax brackets and rates here on efile.com. The irs changes these tax brackets from year to year to account for inflation and other changes in economy. 2022 tax brackets for single filers, married couples filing jointly, and heads of households;