2022 Tax Brackets Ny. Check the 2022 new york state tax rate and the rules to calculate state income tax 5. On april 19, 2021, the governor of new york, andrew cuomo, signed the fy 2022 budget bills (chapter 59 of the 2021 laws of new york) into law.

Check the 2022 new york state tax rate and the rules to calculate state income tax 5. 2022 tax brackets and rates in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). You may also be interested in using our free online 2022 tax calculator which automatically calculates your federal and state tax return for 2022 using the 2022 tax tables (2022 federal income tax rates and 2022 state tax tables).

United States Social Security Administration

Importantly, two tax brackets were added to the individual income tax code. [7] louisiana lawmakers’ comprehensive tax reform package, which was approved by voters, includes consolidating the state’s five corporate income tax brackets into three and reducing the top rate from 8 to 7.5 percent as of january 1, 2022. Indiana’s final scheduled rate reduction from 5.25 percent to 4.9 percent kicked in on july 1, 2021.

1 One Of The Provisions Contained In The Enacted Legislation, Which Provides For $212 Billion In State Spending, Temporarily Increases The Current Top Personal Income Tax Rate Of 8.82% To 10.9% For Individual Filers Whose.

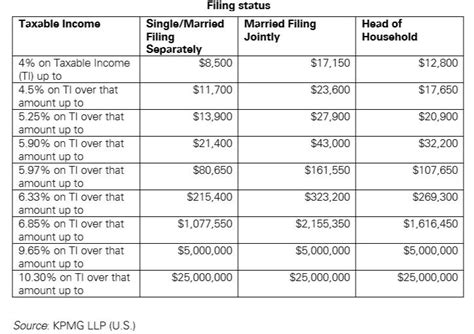

And then you’d pay 22% on the rest, because some of your $50,000 of taxable income falls into the 22% tax bracket. New york state income tax rates are 4%, 4.5%, 5.25%, 5.9%, 6.09%, 6.41%, 6.85% and 8.82%. New york’s 2022 withholding certificate was released jan.

This Page Has The Latest New York Brackets And Tax Rates, Plus A New York Income Tax Calculator.

Tax bracket tax rate ; The total bill would be about $6,800 — about 14% of your taxable income, even. Calculate your state income tax step by step 6.

10%, 12%, 22%, 24%, 32%, 35% And 37%.

New york city has four separate income tax brackets that range from 3.078% to 3.876%. Residents of new york state are subjected to income tax (4% to 10.9%) and state payroll taxes such as disability insurance (sdi) and paid family and medical leave (pfml). The income tax system in new york city is also a progressive tax system with tax rates that range from 3.078% to 3.876%.

Here's Who Pays New York State Tax, Residency Rules & What's Taxable.

2022 tax brackets and rates in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). New york income tax forms. Where you fall within these brackets depends on your filing status and how much you earn annually.