Estimated Tax Payments 2022 Turbotax

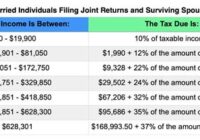

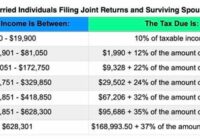

Estimated Tax Payments 2022 Turbotax. 90% of your estimated 2022 taxes 100% of your actual 2021 taxes (110% if your adjusted gross income was higher than $150,000, or $75,000 if married. B) 100% of the tax shown on your 2021 tax return. How To Estimate Tax Refund 2022 Latest News Update from neswblogs.com If the estate or trust… Read More »