Income Tax 2022 Percentage

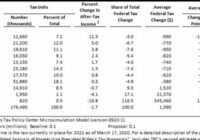

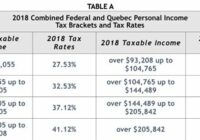

Income Tax 2022 Percentage. However, for 2022 if you make the same salary, your income now falls in the 12 percent tax bracket. In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). What did the tax payers get in the budget? Only from… Read More »