Income Tax 2022 Single

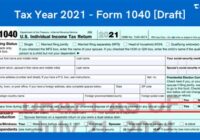

Income Tax 2022 Single. The state and local tax deduction, known as the salt deduction, lets you deduct the value of your state and local property tax payments, plus either your income or sales taxes. For example, a single taxpayer will pay 10 percent on taxable income up to $10,275 earned in 2022. Special Bulletin Federal Budget 201920… Read More »