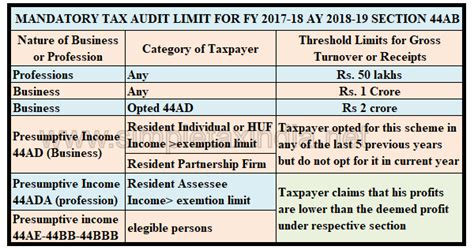

Tax Audit Limit For Ay 2022-23. Audit limit of rs.10 crore applicable from f.y. B) the threshold limit of rs.

What are the twists involved in it? Read more about the due dates of compliances in financial year. How to avail of the benefit of the enhanced limit of rs.

B) The Threshold Limit Of Rs.

Know about tax audit u/s 44ab of the income tax act. 1 crore during the previous year. So kindly clarify in your post, is this right or wrong ?

10 Crores For The Tax Audit?

Turnover limit for tax audit increased to rs.10.00 crores. 44ab clause a in fa 2019 Read more about the due dates of compliances in financial year.

A) 0.5% Of Total Sales, Turnover, Or Gross Receipts As The Case May Be (In Business), Or Of The Gross Receipts In The Profession, In Such Year Or Years.

Any other person who is obliged to furnish the tax audit report. Yes, it will be applicable. What are the twists involved in it?

Deduction Of Tax At Source At 1% If Recipient Is An Individual Or Huf

The discussion in article is only w.r.t tax audit for person carrying on business. Therefore, tax shall be deduction from payment of interest on recurring deposit if it exceeds the threshold limit of rs. The due date for filing audit report has been further extended to february 15, 2022 vide circular no.

Audit Limit Of Rs.10 Crore Applicable From F.y.

Tax is required to be deducted only if sum paid exceeds rs. 30,000 or aggregate of sum paid during the financial year exceeds rs. Let us try to understand the complexity involved it the said provision and things to be taken care by the assessee.