Tax Calculator 2022-23 India. Learn how income tax is calculated using an online income tax calculator. You can edit all cells in orange colour.

Disclaimer:the above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. Suppose you live in company provided residence, but does not have nps facility or medical insurance premium or donated to. Find the calculator you need here:

After The Budget, This Calculator Will Tell You What Difference The Budget Has Made.

Salaried employees ctc income tax calculation: The 2022 tax tables are provided in support of the 2022 india tax calculator. Icalculator also provides historical indian earning figures so individual employees and employers can review how much tax has been paid in previous assessment years or you can use the salary calculator 2022/23 to see home much your take home salary will be in 2022.

25% Of Income Tax, In Case Taxable Income Is Above ₹ 2 Crore.

The calculator uses necessary basic information like annual salary, rent paid, tuition fees, interest on child’s education loan, and any other savings to calculate the tax liability of an individual. This calculator will work for both old and new tax slab rate which were released in 2020. Take a look at tax rules for reimbursement, conveyance, variable pay, bonus, da, gratuity, hra written by rajeev kumar february 19, 2022 2:48:20 pm

Just Enter In Your Salary And Find Out How Much Income Tax And National Insurance You'll Pay.

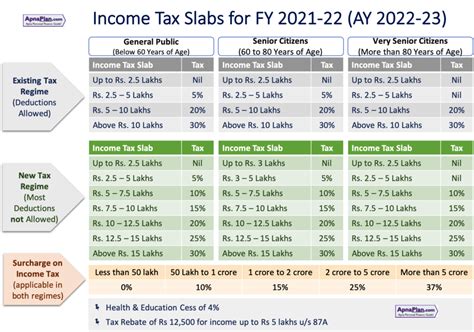

37% of income tax, in case taxable income is above ₹ 5 crore. This is the case of customization, means you can calculate based on your profile. You can calculate your 2022 take home pay based of your 2022 gross income, education tax, nis and income tax for 2022/23.

Information Relates To The Law Prevailing In The Year Of Publication/ As Indicated.viewers Are Advised To Ascertain The Correct Position/Prevailing Law Before Relying Upon Any Document.

Information relates to the law prevailing in the year of publication/ as indicated.viewers are advised to ascertain the correct position/prevailing law before relying upon any document. You can edit all cells in orange colour. To calculate the in hand salary, one should enter the cost to company (ctc) and the bonus if there is any, as a fixed amount or percentage of the ctc.

This Calculator Provides Comprehensive Coverage For Every Type Of Assessee And All Heads Of Income.

The following india income tax slabs (tax tables) are valid for the 2022/23 tax year which is also knows as financial year 22/23 and assessment year 2022/23. The indian salary calculator includes income tax and salary deductions looking for a different calculator? The indian 2022 tax calculator is updated for the 2022/23 assessment year.