Tax Calculator 2022 By State. Tax calculators and tax tools to check your income and salary after deductions such as uk tax, national insurance, pensions and student loans. The personal income tax rate in the us is progressive and assessed both on the federal level and the state level.

This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs. If you paid less, you may owe a balance. Calculate your tax year 2022 take home pay after federal/state/local taxes, deductions and exemptions.

This Income Tax Calculator Can Help Estimate Your Average Income Tax Rate And Your Salary After Tax.

See your tax refund estimate. The indian 2022 tax calculator is updated for the 2022/23 assessment year. After a few seconds, you will be provided with a full breakdown of the tax you are paying.

Actual Results Will Vary Based On Your Tax Situation.

We’ll calculate the difference on what you owe and what you’ve paid. Us federal income tax brackets and other information. You can calculate your 2022 take home pay based of your 2022 gross income, education tax, nis and income tax for 2022/23.

The Income Tax Rate Ranges From 4% To 10.9%;

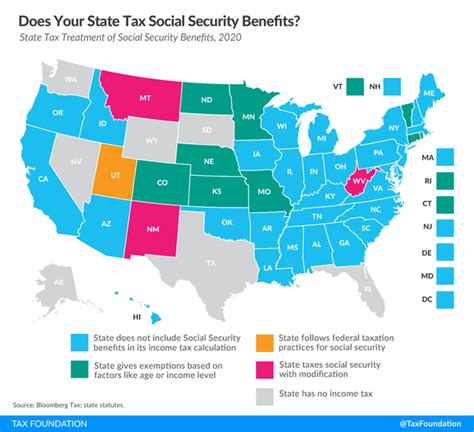

Simply enter your annual salary to see a detailed tax calculation or select the advanced options to edit payroll information, select different tax states etc. If you paid less, you may owe a balance. So for 2022, any income you earn above $147,000 doesn’t have social security taxes withheld from it.

The German Tax Calculator Is A Free Online Tax Calculator, Updated For The 2022 Tax Year.

The alabama state tax tables for 2022 displayed on this page are provided in support of the 2022 us tax calculator and the dedicated 2022 alabama state tax calculator. This means that each of the buyer and seller pay.75% to the county and 1.25% to the state. Some cities may impose city level income taxes too.

If You Make $55,000 A Year Living In The Region Of New York, Usa, You Will Be Taxed $12,213.That Means That Your Net Pay Will Be $42,787 Per Year, Or $3,566 Per Month.

The brackets for these tax rates can also differ according to your filing status. To use our north carolina salary tax calculator, all you have to do is enter the necessary details and click on the calculate button. The personal income tax rate in the us is progressive and assessed both on the federal level and the state level.