Tax Calculator 2022 Car. Vehicles with an original list price of more than £40,000 will also attract an additional rate of £335 per year for 5 years. The vehicle’s wholesale value is greater than your purchase price, so that value will be used for calculating your sales tax.

Auto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator. Icalculator aims to make calculating your federal and state taxes and medicare as. Instantly compare with taking a cash allowance instead.

The Results Will Be Displayed Below It.

The amount of ved you’ll pay depends on how old your car is and how environmentally friendly it is: The fiscal code establishes an appropriate tariff for each category of means of transport. Yourtax tax calculator compare yearly tax changes;

Use The Car Tax Calculator To Find The Car Tax Payable For A Specific Make And Model In 2021/22.

Find your state below to determine the total cost of your new car, including the car tax. Select model to calculate car tax Select the used button if your car is not currently available to purchase as a new model.

This Amount Will Be Multiplied By Each Group Of 200 Cm3 Or A Fraction Thereof.

Presently, the percentage of road tax in this state is 7%. How to use bir tax calculator 2022. Vehicles with an original list price of more than £40,000 will also attract an additional rate of £335 per year for 5 years.

Vehicle Excise Duty (Also Known As Vehicle Tax, Car Tax Or Road Tax) Is Set To Rise In Line With Inflation From April 2022 And Will See The Cost Of Owning A Petrol Or Diesel Vehicle Rise.

A car allowance calculator for the 2022 tax year that calculates your claim based on the fixed cost method provided by sars. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees. Just enter in your salary and find out how much income tax and national insurance you'll pay.

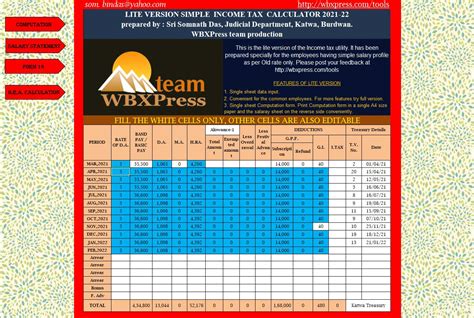

Income Tax Calculator For Tax Resident Individuals.

Sars income tax calculator for 2022 work out salary tax (paye), uif, taxable income and what tax rates you will pay Company car tax payable by an employee is based on the vehicle's p11d value multiplied by the appropriate bik rate (determined by the car's co2 and fuel type) and the employee's income tax rate (basic rate of 20%, higher rate of 40% or additional rate of 45%). However, in some provinces, harmonized sales tax (hst) must be used.