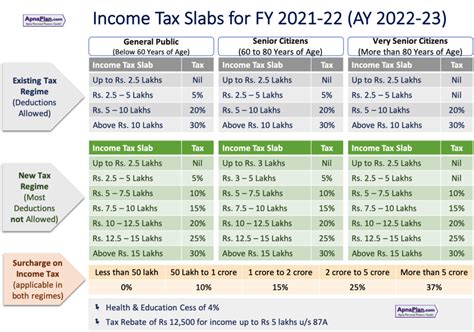

Tax Calculator 2022 Old Regime. Tax liability in india differs based on the age groups. 13 feb 2022, 12:11 pm ist eta ojha.

Has introduced a new tax regime (system) from last financial year (with a lower tax rate without any exemption/deduction). Choosing an old or new income tax regime is completely your own decision and it will depend on your income structure, available deductions, and. Updated with latest tax rates & expectations for #budget2022

This Calculator Is Designed To Work With Both Old And New Tax Slab Rates Released In The Budget 2020.

Click here to view relevant act & rule. An income tax calculator is a simple online tool which can help you calculate taxes payable on your income. Here’s a quick guide to help you determine what you’ll be liable for.

Income Tax Saving Guidelines For Employee's.

Payhr income tax calculator is an simple online tax calculator tool that helps you to estimate your tax based on your income. This tax calculator will show comparison of both tax regime. 3 lakh for senior citizens (between 60 and 80 years) rs.

As Per The Old Tax Regime For Fy 2021 & Fy 2022, Super Senior Citizens (Aged 80 And Older) And Entitled To A Limit Of Income Tax Exemption Amounting To Up To ₹5 Lakhs.

This compares the new vs old tax regime and nris can also use this So basically, every person will have his own unique new tax slab vs old tax slab calculation as the deductions claimed by the person may be unique to him. Tax rate as per old regime:

Which Will Continue In This Financial Year Too.

It’s not always a straightforward process to calculate import duty and tax and, in the united states, it can be especially confusing. Note that irrespective of the chosen regime, the basic income tax calculation formula remains the same. We have updated our income tax calculator according to the latest income tax rates & rules, so you may calculate your tax with accuracy and without worry.

Choose The Financial Year For Which You Want Your Taxes To Be Calculated.

Click here to view relevant act & rule. Choosing an old or new income tax regime is completely your own decision and it will depend on your income structure, available deductions, and. Following are the steps to use the tax calculator: