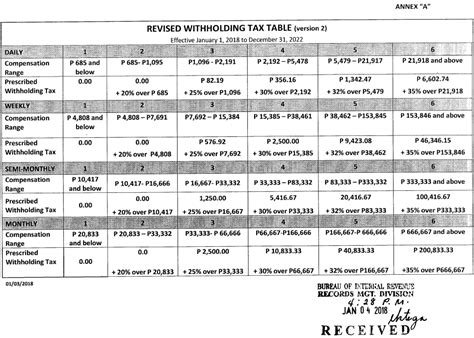

Tax Calculator 2022 Philippines. This tax calculator will provide a simplified computation of your monthly tax obligation under the new tax reform. Accordingly, the withholding tax due computed by the calculator cannot be used as basis of complaints of employees against their employers.

Philippines 2024 income tax calculator; Salary and allowances of husband arising from employment: Then select your irs tax return filing status.

Salary And Allowances Of Husband Arising From Employment:

This tax calculator will provide a simplified computation of your monthly tax obligation under the new tax reform. Graduated income tax rates until december 31, 2022. Choose a specific income tax year to see the philippines income tax rates and personal allowances used in the associated income tax calculator for the same tax year.

Icalculator Aims To Make Calculating Your Federal And State Taxes And Medicare As Simple As Possible.

Our online annual tax calculator will automatically. Salary of php 652,000, living allowances of php 100,000, and housing benefits (100%) of php. This calculator is updated with rates and information for your 2020 taxes, which you’ll file in 2021.

Free Tax Code Calculator 2.

No validation process is being performed on the. Save your calculations on your computer for future reference. How to compute your income tax based on graduated rates.

Transfer Unused Allowance To Your Spouse:

Philippines 2024 income tax calculator; Follow these simple steps to calculate your salary after tax in philippines using the philippines salary calculator 2022 which is updated with the 2022/23 tax tables. Procedures for availment of tax subsidy of goccs.

Enter Your Salary And The Philippines Salary Calculator Will Automatically Produce A Salary After Tax Illustration For You, Simple.

Please choose a country from the list below to access specific tax calculators, salary calculators and associated finance calculators for that country. Philippines 2021 income tax calculator (i) those earning an annual salary of p250,000 or below will no longer pay income tax (zero income tax).