Income Tax 2022 Philippines Calculator. Example of a standard personal income tax calculation in philippines philippine social tax contributions, if any, made by the resident alien and/or his wife to the philippine social security agencies shall be allowed as deductions from gross income in calculating their tax liabilities for the year. January 11, 2022 | updated:

Review the 2022 philippines income tax rates and thresholds to allow calculation of salary after tax in 2022 when factoring in health insurance contributions, pension contributions and other salary taxes in philippines Calculate your combined federal and provincial tax bill in each province and territory. Ok, thank you please remind me.

Finish In 20 Minutes Or Less.

Always use a new copy for preparation of it bill. Details on the 2022 calculator: The calculator is designed to be used online with mobile, desktop and tablet devices.

2018/02/02 · Refer To Bir’s Withholding Tax Table To Know Which Bracket Your Result From Step 2 Will Fall.common Transactions Where Dst Will Apply.

See over 15 free tax tools courtesy of efile.com to use in preparing your 2021 return. The calculator reflects known rates as of january 15, 2022. To estimate the impact of the train law on your compensation income, click here.

To Access Withholding Tax Calculator Click Here.

Use this free tax tool to get an understanding of what your 2022 taxes could look like. Calculate your combined federal and provincial tax bill in each province and territory. More information about the calculations performed is available on the about page.

This Tax Calculator Will Provide A Simplified Computation Of Your Monthly Tax Obligation Under The New Tax Reform.

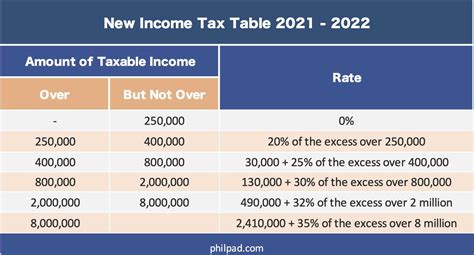

January 11, 2022 | updated: The income tax system in the philippines has 6 different tax. Review the 2022 philippines income tax rates and thresholds to allow calculation of salary after tax in 2022 when factoring in health insurance contributions, pension contributions and other salary taxes in philippines

It Has Also Embedded Tax Slab Rates For The Previous Year.

These free calculation services help you determine the tax on rental income annually and monthly. Tax table 2022 philippines calculator. This bir tax calculator helps you easily compute your income tax, add up your monthly contributions, and give you your total net monthly income.