Income Tax 2022 Philippines. Tax rates for income subject to final tax. With the new tax reform, middle and low income earners will be exempted from income tax.

The intent was to give you an estimate of your remaining salary after all the tax deductions. New graduated tax rates will also be in effect from 1 january 2023 onwards. United arab emirates 16:05 gdp (yoy) forecast:

8% Income Tax On Gross Sales Or Gross Receipts In Excess Of P250,000 In Lieu Of The Graduated Income Tax Rates And The Percentage Tax;

This income tax calculator can help estimate your average income tax rate and your salary after tax. United arab emirates 16:05 gdp (yoy) forecast: 20% of the excess over p250,000.00.

Philippines Corporate Tax Rate Was 30 % In 2022.

Some examples of income tax exemptions are: Philippines residents income tax tables in 2022: Not everyone is required by law to pay taxes.

Tax Table 2022 Philippines Calculator.

Income tax rates and thresholds (annual) tax rate. Tax rates for income subject to final tax. 2021/08/31 · regular corporate income tax (rcit) for corporations and regular income tax for individuals apply to the sale of ordinary assets while cgt applies to the sale of capital assets.

2018/02/02 · Refer To Bir’s Withholding Tax Table To Know Which Bracket Your Result From Step 2 Will Fall.common Transactions Where Dst Will Apply.

January 11, 2022 | updated: How many income tax brackets are there in the philippines? The changes included the option to avail of the eight percent flat income tax rate and the use of the enhanced bir firm 1701 or the annual income tax return for mixed income earners, estates and.

Workers Earning Less Than ₱21,000 A Month Will Be Exempted, Because Their Salary Is Less Than The Lowest Tax Brackets Implemented In.

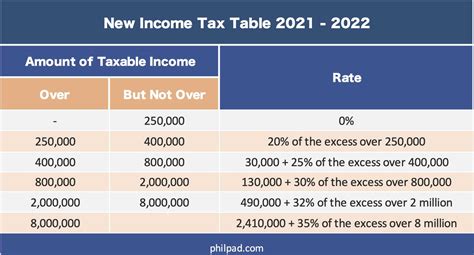

The intent was to give you an estimate of your remaining salary after all the tax deductions. Philippines income tax rates in 2022. New graduated tax rates at 0%, 20%, 25%, 30%, 32%, and 35% will be in effect from 1 january 2018 until 31 december 2022.