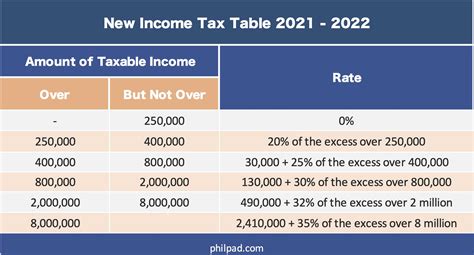

Income Tax Table 2022 Philippines. Philippines residents income tax tables in 2022: Income tax rates and thresholds (annual) tax rate taxable income threshold;

The pay of sg 1 workers will increase to php 12,034 in 2021, php 12,517 in 2022, and php 13,000 in 2023. Income tax rates for individuals. How many income tax brackets are there in the philippines?

Please Enter Your Total Monthly Salary.

Philippine tax withholding calculator for 2022 published: Philippines residents income tax tables in 2022: 2021/08/31 · regular corporate income tax (rcit) for corporations and regular income tax for individuals apply to the sale of ordinary assets while cgt applies to the sale of capital assets.

The Tax Filing And Payment Deadline For 2019 Annual Income Tax Returns Was Extended To 14 June 2020 (Initially Extended To 15 May.

Income tax rates and thresholds (annual) tax rate taxable income threshold; Income tax rates in the philippines. If you don’t fully understand the table above, we have made a simplified revised withholding tax table of bir.

This Will Be Effective Starting January 1, 2018 Until December 31, 2022.

Income tax table for 1 january 2018 to 31 december 2022. The bureau of internal revenue (bir) has circularized the revised withholding tax table which should be used in computing tax withheld on every payment of employee compensation. The compensation income tax rate in the philippines is progressive and ranges from 0% to 35% depending on your income.

January 11, 2022 | Updated:

Home » tax bracket rates » estate tax rate schedule 2022 » 2021 philippine income tax tables under train pinoy 2021 philippine income tax tables under train pinoy by admin | published september 28, 2021 | full size is 1024 × 535 pixels Income tax rates and thresholds (annual) tax rate taxable income threshold; 8% income tax on gross sales or gross receipts in excess of p250,000 in lieu of the graduated income tax rates and the percentage tax;

₱2,400 Per Year Or ₱200 Per Month Worth Of Premium Payments On Health And/Or Hospitalization.

₱25,000 worth per qualified dependent child. Personal income tax rate in philippines is expected to reach 35.00 percent by the end of 2021, according to trading economics global macro models and analysts expectations. The table is effective from january 1, 2018 to december 31, 2022.