Income Tax 2022 Budget. This income could either be actual, notional, or both. The budget 2022 will be presented around 11 am on 1st february 2022.

Earned personal circumstances 2020 € 2021 € single or widowed or Taxpayers who have made errors while filing return (omission of income, etc.), can file updated return by payment of taxes within 2 years. The budget is technology driven which mainly focuses on infrastructural development.

Har Ghar, Nal Se Jal:

The budget 2022 will be presented around 11 am on 1st february 2022. In the union budget 2022, the one with the shortest speech, fm nirmala sitharaman did not have much to offer to the common man or middle class. While it’s safe to say, the income tax proposals under union budget 2022 don’t rock the boat, in this article we highlight some of the key changes.

Balance T Exemption Limits The Exemption Limits For Persons Aged 65 Years And Over Remain Unchanged.

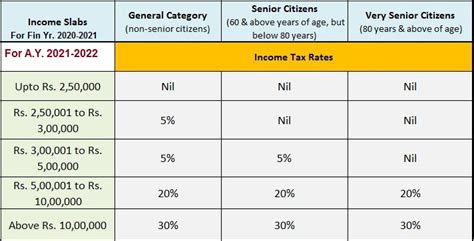

Income tax is a tax amount that is paid by an individual, group of people or entities based on their level of gains and income during a particular financial year. Finance bill, 2022, proposes to do away with concessional rate of tax on dividend received from foreign companies. Finance minister nirmala sitharaman announced that any income from transfer of any virtual digital asset will be taxed at a rate of 30 percent.

Budget For The Year 2022 Was Presented By Hon’ble Finance Minister Smt.

Hon’ble finance minister nirmala sitharaman presented the union budget 2022 against the backdrop of a resilient economy that is growing at 9.2 per. It is past high time to take a risk on a fresh concept to personal income taxation. Levy of surcharge @ 12% in cases where tax has to be charged and paid.

01 Feb 2022, 04:50 Pm Ist eta Ojha Taxpayers Can File Updated Itr Within Two Years Of The Relevant Assessment Year.

Income tax budget 2022 live: No change in income tax slabs, revised itr filing window now open for 2 years from ay the finance minister however gave respite to people filing their revised income tax return (itr) by expanding the tax filing window. Specified foreign company means a foreign company in which the indian company holds 26% or more equity stake.

The Budget Is Technology Driven Which Mainly Focuses On Infrastructural Development.

This income could either be actual, notional, or both. Some minor changes under the income tax laws which affect individual tax payers have been proposed in the budget 2022 by the finance minister. It is expected that there will be certain relaxations for salaried individuals and that the standard deduction may increase from 50,000, especially in.