Income Tax Budget 2022 India. Finance bill, 2022, proposes to do away with concessional rate of tax on dividend received from foreign companies. Income between ₹ 1,00,001 and ₹ 12,50,000.

The second india income tax slab in 2022 is for individuals over 60 years of age but under 80 years of age. Yougov's latest survey shows sentiments of. Ltcg surcharge rate at 15%, updated return and more to help taxpayers

Replacing Income Tax With Expenditure Tax Is The Blockbuster Reform India Needs The Union Budget For This Year Will Be Presented On February 1,.

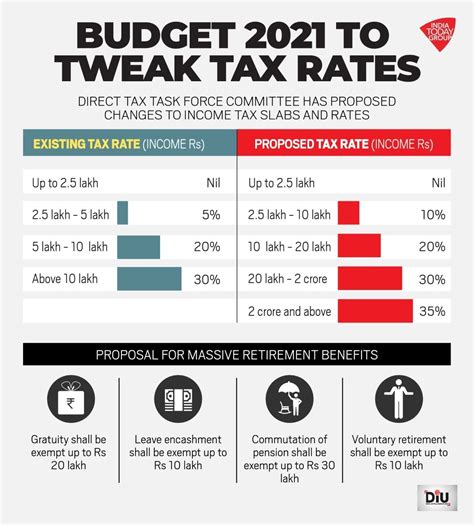

Income between ₹ 12,50,001 and ₹ 15,00,000. Budget 2022 did not provide any relief in terms of income tax budget 2022 has proposed to increase the tax deduction limit from 10% to 14% on employer’s contribution to the nps account of state government employees finance minister has again hinted that the country's biggest ipo, lic, will be rolled out soon finance minister nirmala sitharaman has proposed to. Has been decided by the government of india and is based on the union budget 2021 income tax.

Specified Foreign Company Means A Foreign Company In Which The Indian Company Holds 26% Or More Equity Stake.

Finance minister nirmala sitharaman on tuesday proposed a 30 per cent tax on income from transactions in virtual digital assets. 20 per cent of the total income that is more than rs 10 lakh plus rs 75,000 above 12.50 lakh to rs 15 lakh: Income between ₹ 1,00,001 and ₹ 12,50,000.

In India, The Income Tax Is Based On A Slab System On Which The Taxpayers Have To Pay.

25 per cent of the total income that is more than 12.5. Rationalisation of surcharge by capping it at 15% on long term. Yougov's latest survey shows sentiments of.

Exempt Wfh Expenses, Says Deloitte Deloitte Believes The Move Is Needed To Bring Parity In Personal Income Tax With The Corporate Tax Rate That Were Reduced In 2019

Budget 2022 serves well the cause of macroeconomics to support the growth momentum in our economy. 1,00,000 and wfh employees were also expecting some tax relief especially for. 5 income tax changes announced in budget 2022 taxpayers must be aware of some minor changes under the income tax laws which affect individual tax payers have been proposed in the budget 2022 by.

Economic Survey Cuts Growth Estimates From 9.2% To 8.5% Advertisement India's Economic Growth In The Current Year Is Estimated To Be 9.2 Percent, The Highest Among All Large.

Ltcg surcharge rate at 15%, updated return and more to help taxpayers There are no proposals to the basic income tax exemption limit, income brackets (“slabs”), and tax rates. It reflects pm modi's mantra of 'sabka sath, sabka vikas'.