Income Tax 2022 Budget India. Budget 2022 income tax news live: Tax on income from virtual assets, a perpetual amnesty scheme of sorts for unreported income, cap on the surcharge on long term capital gains, end date for concessional rate of tax on dividend received from foreign companies, and timeline extension for manufacturing companies are among the key direct tax.

Economic survey cuts growth estimates from 9.2% to 8.5% advertisement india's economic growth in the current year is estimated to be 9.2 percent, the highest among all large. Income tax budget 2022 income tax budget 2022: Budget 2022 news for income tax payers live updates:

Finance Minister Nirmala Sitharaman Today Announced No Change In Personal Income Tax Slabs And Rates In Budget 2022.

Regarding direct taxation, the budget includes measures to encourage more foreign investments and relief for the real estate and infrastructure sectors. Written by balwant jain february 1, 2022 6:22:19 pm I propose to provide that any income from the transfer of any virtual digital asset shall be taxed at the rate of 30 per cent.

Top 5 Direct Tax Changes.

Economic survey cuts growth estimates from 9.2% to 8.5% advertisement india's economic growth in the current year is estimated to be 9.2 percent, the highest among all large. It reflects pm modi's mantra of 'sabka sath, sabka vikas'. Some minor changes under the income tax laws which affect individual tax payers have been proposed in the budget 2022 by the finance minister.

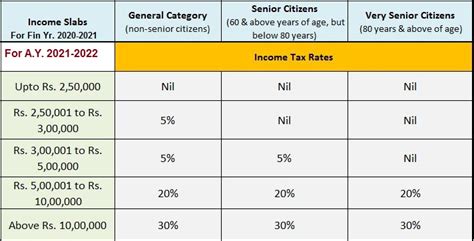

The Third India Income Tax Slab In 2022 Is For Individuals Over 80 Years Of Age And Provides The Lowest Levels Of Personal Income Tax In India.

Rationalisation of surcharge by capping it at 15% on long term. Income tax budget 2022 income tax budget 2022: In india, the income tax is based on a slab system on which the taxpayers have to pay.

Income Between ₹ 15,00,001 And ₹ 1,00,00,00,00,00,00,00,00,90,59,69,664.

Govt may make new simplified personal income tax regime more attractive. Income between ₹ 1,00,001 and ₹ 12,50,000. Raghav aggarwal | january 22, 2022 3:45 pm ist.

Tax On Income From Virtual Assets, A Perpetual Amnesty Scheme Of Sorts For Unreported Income, Cap On The Surcharge On Long Term Capital Gains, End Date For Concessional Rate Of Tax On Dividend Received From Foreign Companies, And Timeline Extension For Manufacturing Companies Are Among The Key Direct Tax.

Budget 2022 income tax news live: The finance minister however gave respite to people filing their revised income tax return. Has been decided by the government of india and is based on the union budget 2021 income tax.