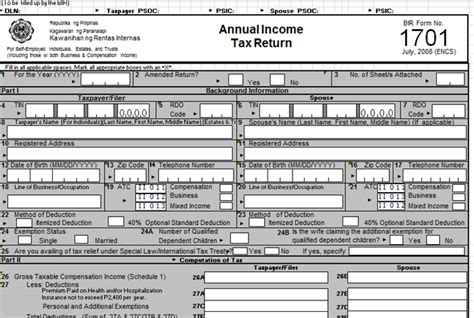

Annual Income Tax Return Deadline 2022 Philippines. What is an income tax refund? Corporate taxpayers must file their income tax returns using one of three different forms, depending on their tax regime (i.e.

A final annual income tax return must be filed on or before the 15th day of the fourth month following the close of the taxable year. Corporate taxpayers must file their income tax returns using one of three different forms, depending on their tax regime (i.e. Failure to meet the deadline will result in penalties such as a 25% surcharge of the tax due and a 20% interest per year from the deadline of payment until full payment of the amount.

Monthly Vat 3 Return And Payment (If Due) For The Period January Together With A Return Of Trading Details Where The Vat Accounting Period Ends In January.

F30 monthly return and payment for january 2022. For taxation years beginning after 2020, the return is due 10 months 3 following a corporation’s year end, therefore for a december 31, 2021 year end, the return must be filed by october 31, 2022. November 15 or 45 days after end of each quarter:

The Penalty Waivers Will Mean That:

The deadline to file and pay remains 31 january 2022. Quarterly income tax return (for. From 2018 to 2022, that employee paid income tax in the amount of p190,000 during the implementation of train.

Corporate Taxpayers Must File Their Income Tax Returns Using One Of Three Different Forms, Depending On Their Tax Regime (I.e.

Anyone who cannot file their return by the 31 january deadline will not receive a late filing penalty if. Note that whatever the source is, tax refunds must be availed not later than 2 years from supposed filing. Income tax rates and thresholds (annual) tax rate taxable income threshold;

What Is An Income Tax Refund?

The income tax return shall be filed with any authorized agent bank (aab) located within the territorial jurisdiction of the revenue district office where the taxpayer is required to register/where the taxpayer has his legal residence or place of business in the philippines. Tax refunds result from the overpayment of taxes. Submission of notarized sworn declaration of new income recipients, availing of lower ewt rate or tax exemption, by withholding agents to the bir for november 2022.

F35 Annual Return For Year Ended 31 December 2021:

Tax returns and remittance forms. Annual income tax return (for corporations and partnerships) april 15: Subject only to the regular income tax, tax exempt, or with mixed income subject to multiple tax rates or.