Tax Calculator 2022 Take Home Pay. This marginal tax rate means that your immediate additional income will be taxed at this rate. You can calculate your take home pay based of your annual salary and include tax deductible elements such as head of household, blind and age related allowances.

Finally, your take home pay after deducting income tax and medicare. In addition to income tax, there are additional levies such as medicare. If you make $52,000 a year living in the region of ontario, canada, you will be taxed $11,432.

Please Enter Your Total Monthly Salary.

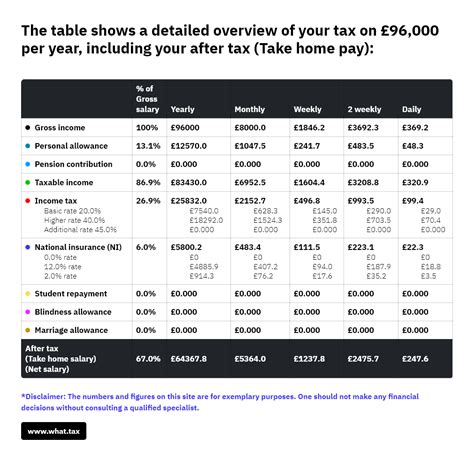

Just enter in your salary and find out how much income tax and national insurance you'll pay. Tax deducted nics deducted take home pay tax rate % £10,500: The results will be displayed below it.

Enter The Bonus Included In The Ctc As A Percentage Or Amount.

To use the salary calculator: Australian income is levied at progressive tax rates. Icalculator aims to make calculating your federal and.

The Canada Annual Tax Calculator Is Updated For The 2022/23 Tax Year.

All the relevant figures from the taxman have been input and we constantly check to make sure updates and errors are corrected. This calculator is intended for use by u.s. Use the simple 2022 tax calculator or switch to the advanced 2022 tax calculator to review nis payments and income tax deductions for 2022.

You May Be Entitled To A Portion Of The Home Carer's Credit Where Your Spouse Earns Income In Excess Of €7,200.

The 2022 tax calculator uses the 2022 federal tax tables and 2022 federal tax tables, you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. If you pay income taxes in scotland, simply hit the 'do you live in scotland?' tab to make sure you. You can calculate your 2022 take home pay based of your 2022 gross income, education tax, nis and income tax for 2022/23.

If You Make $52,000 A Year Living In The Region Of Ontario, Canada, You Will Be Taxed $11,432.

If you make $52,000 a year living in the region of ontario, canada, you will be taxed $11,432. You can calculate your take home pay based of your annual salary and include tax deductible elements such as head of household, blind and age related allowances. Income tax on your gross earnings , medicare levy(only if you are using medicare) , superannuation paid by your employer (standard rate is 9.5% of your gross earnings).