Tax Refund 2022 With Child Tax Credit. However, as part of the american rescue plan package, millions of parents received monthly advances of their child tax credits from july through december of 2021. That would mean they can claim the full credit when they file their 2021 taxes:

During the current year’s markdown, families who are ready for the youngster’s credit will get at. The size of the credit will be cut in 2022, with full payments only going to families that earned enough income to owe taxes, a policy choice that. Kid tax credit payments 2022 kid tax reduction settlements early were done in december 2021, and the additional juvenile obligation decline subsidizes will be conveyed off qualified watchmen close by their 2021 government structures in the 2022 expense season.

The Enhaced Ctc Are Not Permanent Parents Of Newborns In 2021 Are Eligible For The Child Tax Credit.

In 2021, the child tax credits were temporarily boosted to $3,600 from $2,000 under the american rescue act , which was signed into. The size of the credit will be cut in 2022, with full payments only going to families that earned enough income to owe taxes, a policy choice that. President biden’s american rescue plan, implemented in march 2021, increased upfront tax breaks for families with children.

When Filing Taxes In 2022, Claim Your Newborn As A Dependent.

Democrats also beefed up the total child tax credit to a maximum of $3,600 per year for each younger child and $3,000 for. During the current year’s markdown, families who are ready for the youngster’s credit will get at. The program sent monthly checks to eligible families in the latter half of 2021, with up to $300 per month for every child younger than 6.

When Should I Expect My Tax Refund In 2022?

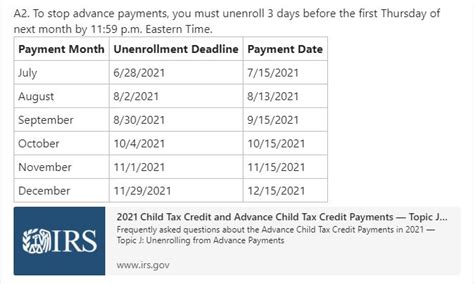

However, as part of the american rescue plan package, millions of parents received monthly advances of their child tax credits from july through december of 2021. Outsiders who received a monthly child tax credit payment in 2021 may be in for a big surprise come tax refund time. Child tax credit eligibility in 2021, you may have received up to $1,800 in monthly payments per child age 5 and younger, and up to $1,500 for kids between ages 6 to 17, based on 2019 or 2020 income.

However, Taxpayers With The Earned Income Tax Credit Or Child Tax Credit Generally Have Their Refunds Delayed By About One Month While The Irs Confirms Eligibility For These Credits.

If you had a baby in 2021 or planning on having one this year then that’s a damm lucky (tax) baby | when you file your taxes in 2022 your going to get a nice chunk of refund for the baby | there’s 2 refunds for the baby: You might be entitled to more child tax credit support. Families who are claiming child tax credits may have to wait longer for a tax refund than they expect.

When The Parents File, They'll Claim A Tax Credit Of $3,000 For The Two Children (Representing One.

The child tax credit you’ve been getting throughout the last year could make your tax refund smaller when you file this spring. Take a family with two children, ages 8 and 10: $3600 child tax credit and $1400 stimulus for a grand total of 5k |.