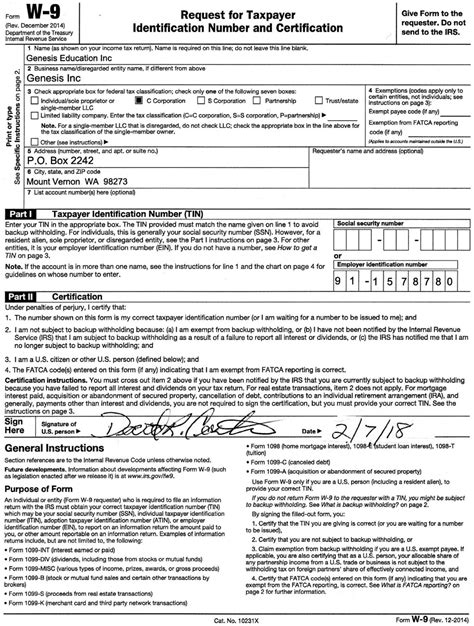

W 9 Form 2022 Who Fills Out. A w9 form can be total in 3 simple actions: Fill out the form with your name, taxpayer, and address identification number.

Generally, only a nonresident alien individual may use the terms of a tax treaty to reduce Fill out the form with your name, taxpayer, and address identification number. The irs uses this details to help determine taxpayers and identify whether they have actually properly reported all earnings.

You Need To Use It If You Have Earned Over $600 In That Year Without Being Hired As An Employee.

This form includes information such as… this entry was posted in fillable w9 on october 12, 2021 by tamar. The irs utilizes this info to assist determine taxpayers and identify whether they have properly reported all income. Fill out the form with your name, taxpayer, and address identification number.

Fill Out The Form With Your Name, Address, And Taxpayer Identification Number;

Generally speaking, freelancers, professional consultants, trade workers, and independent contractors are required to fill out this form. The irs utilizes this info to assist determine and determine taxpayers whether they. Participating foreign financial institution to report all united states 515, withholding of tax on nonresident aliens and foreign entities).

If You Are Formerly Classified As An Independent Contractor Or Freelancer, Your Employer’s Tax Savings Will Come Out Of Your Pocket.

As a contractor or freelancer, you may have completed jobs for. A firm in the us that is paying to you can request that you carry out a w9 form who fills out. Acquisition or abandonment of secured property.

The Irs Utilizes This Information To Help Figure Out And Determine Taxpayers Whether They Have Actually Correctly Reported All Income.

How to complete a form w9? This may be your employer, your real estate broker, or another individual or institution that has a financial relationship with you. Generally, only a nonresident alien individual may use the terms of a tax treaty to reduce

How To Complete A Form W9?

It is required if you earned more than $600 in that year without being recruited to work as an employee. Also read new york 2022 w9 form. Send it to the person who requested it.