When To Pay Real Property Tax Philippines. Revenues of the local government units are earned from their local and external sources. According to the local government code of 1991 or republic act no.

What you need to know about real property tax (rpt) in the philippines. Real property tax is collected every 31st of january each year. It is imposed by the local government unit as specified under the local government code.

Owner/S Of Any Form Of Real Estate.

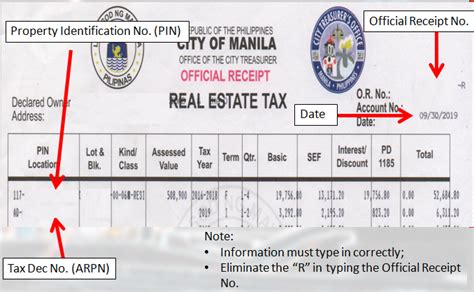

Enter title number and full name (as indicated in the title) Here’s a quick guide on how you can pay your real property tax (rpt) using moneygment: Here are some of the faq about the real property tax that you need to know:

It May Be Paid In Full, In Which Case, Some Local Government Units Give Discounts, Or Quarterly.

How do i pay my property taxes in the philippines? The city government of mandaluyong is implementing an online payment scheme for business and real property taxes, effective july 1, 2020. (for metro manila, calabarzon, central luzon and cebu) login to moneygment;

Upon Receipt Of The Email Confirmation, You Can Pay Your Taxes.

If a taxpayer opts to pay the basic real property tax and the additional tax for public education called special education fund in advance, the municipality concerned may grant a discount of not. However, new taxes, fees or charges, or changes in the rates thereof, shall accrue on the first (1st) day of the quarter next following the effectivity of the ordinance imposing such new levies or rates. For those who choose to pay it in quarterly, deadlines are as follows:

7160, Property Owners Are Required By The Law To Pay The Real Property Tax (Rpt) Every Year.

According to the local government code of 1991 or republic act no. Real property tax accrues every january 1. Gifts and donations worth over php 250,000 are taxed in the philippines.taxable gifts include cash, relief goods, and real and personal properties 2.

Provided, However, That In No Case Shall The Total Interest On The Unpaid Tax Or Portion.

You need to pay inheritance tax because you will inherit your husbands property. According to section 255 of the local government code of the philippines, failing to pay rpt “shall subject the taxpayer to the payment of interest at the rate of two percent (2%) per month on the unpaid amount or a fraction thereof, until the delinquent tax shall have been fully paid: For those who choose to pay it in full, the deadline is before january 31 of each year.